Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Add Diageo (DGE) by Stephen Wright in The Motley Fool

- Add LondonMetric Property (LMP) by Zaven Boyrazian in The Motley Fool

- Add Prudential (PRU) by Andrew Mackie in The Motley Fool

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

Weekly Insight: Tipster Scrutiny on TUI, GSK and Barratt

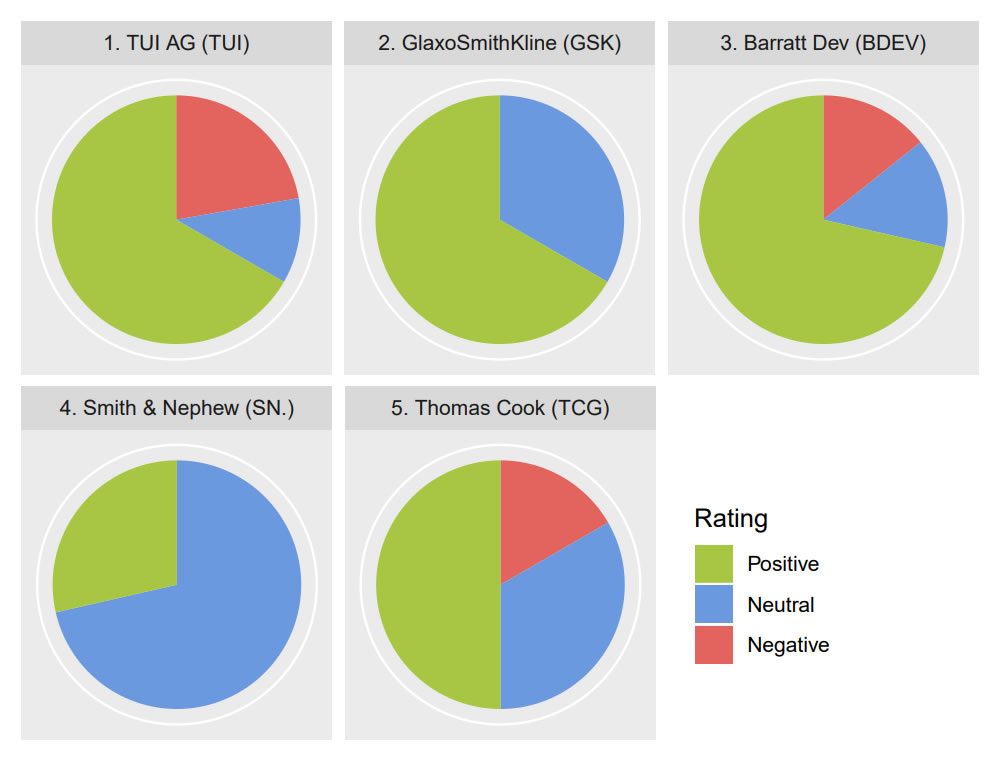

Travel operators TUI AG (TUI) and Thomas Cook Group (TCG) both featured in the top five most frequently tipped companies over the last seven days in a busy week for trading updates. Homebuilders Barratt Developments (BDEV) and RedRow (RDW) also received an influx of tips after both released interim results, while there was increased tip activity for GlaxoSmithKline (GSK) and Smith & Nephew (SN.).

Broker and Tipster Sentiment (Last Seven Days)

On Tuesday, TUI AG (TUI) announced that its first-quarter losses had almost doubled compared to the same period last year, blaming last summer’s heatwave and a weak pound. It’s been a rough 2019 so far for investors in the travel operator with YTD performance of -26.3%. UBS reiterated its sell rating and target price of £12.00. The broker dropped the target price from £12.00 to £10.90 after last week’s profit warning. Berenberg offer a contradictory opinion and rate the firm as a buy, with an accompanying target price of £15.00. Shares were trading at £8.26 early on Thursday. Motley Fool authors Peter Stephens, Tezcan Gecgil and Royston Wild all rate the shares as a buy.

GlaxoSmithKline (GSK) generated the same amount of tips as TUI over the last seven days (9) after publishing better than expected full year results last week. The pharmaceuticals group warned that earnings this year were likely to be hit by rival drugs, but that didn’t stop the positive ratings flooding in. HSBC and UBS both reiterated buy ratings with target prices of £18.60 and £17.00, respectively. Shares were trading at £15.59 in Thursday trade. The Motley Fool’s Edward Sheldon and Royston Wild consider the shares to be a long term buy, with Rupert Hargreaves and Roland Head also positive on the shares. Deutsche Bank and Barclays offered a neutral stance, offering up target prices of £15.20 and £16.00.

Tipsters also contributed buy recommendations this week. Tom Winnifrith (Nifty Fifty) considered the shares as an income buy, reaffirming his earlier position (taken in October last year) that “the dividend was attractive whilst awaiting the shares to catch up with the operational progress” and still targeting a share price above £6.00. Malcolm Stacey (ShareProphets) offered a cautious buy rating, finding that “the PE of many home-operating companies has dipped because investors have been shunning British shares in favour of developing markets that do not suffer the negative Brexit media coverage”. Rupert Hargreaves (The Motley Fool) reiterated a buy stance, declaring the BP share price to be “the FTSE 100 buy of the decade”. Fellow Motley Fool author Peter Stephens rated the shares as a long term buy, due in part to the share price’s 6% yield. The last negative tipster opinion on BP came from G A Chester (The Motley Fool) back in August 2018.

Barratt Developments (BDEV) announced last week that is plans to pay out special dividends in 2019 and 2020, as it assured investors that “the full year remains in line with the Board’s expectations”. The news was well-received by brokers and tipsters, despite broker Liberum subsequently downgraded the shares from a buy to a hold. Peel Hunt was one of several brokers reiterating a positive rating, lifting its target price from £5.10 to £5.75. Shares were trading at £5.64 early on Thursday. Malcolm Stacey (ShareProphets) was also bullish on the homebuilder’s prospects although G A Chester (The Motley Fool) offered the only negative rating, reaffirming his belief that shares should be avoided.

Smith & Nephew (SN.) shares were up after it published final results on Thursday last week, although brokers and tipsters took a cautious stance. The share price has since dropped following speculation about a $3bn acquisition of US surgical instruments maker NuVasive. Brokers Exane, JP Morgan, Goldman Sachs and Credit Suisse all published neutral ratings following the release of the medical equipment manufacturers latest numbers. The average target price of those four ratings was £14.68, with shares currently trading almost exactly in line at £14.67. Alex Ralph (The Times) was also cautious, taking a hold position in the shares, while Royston Wild and G A Chester (both The Motley Fool) considered the shares to be a buy.

Finally, Thomas Cook Group (TCG) – which last featured in the Stockomendation blog back in November last year – was again subject to an influx of tips over the last few days. The travel agent released its first quarter statement last week, and announced that it was conducting a “strategic review” of its airline. Broker and tipster reception was mixed, but mostly positive. Tipster Chris Bailey (ShareProphets) reiterated a positive outlook on the firm’s future, with HSBC issued a buy rating with a target price of 34p. UBS reiterated a neutral rating with a target price of 32p, while Berenberg consider the shares to be a sell with an accompanying target price of 12p. Shares swapped hands at 28p early on Thursday.

The information in this article is provided by Stockomendation, a multi-award winning Fintech50 platform allowing members access to over 45,000 performance-tracked stock tips. Sign up for FREE at www.stockomendation.com

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 14th February 2019.