Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Avoid Tortilla Mexican Grill (MEX) by Steve Moore in ShareProphets

- Watch Tandem Group (TND) by Steve Moore in ShareProphets

- Buy BT Group (BT.A) by Simon Watkins in The Motley Fool

- Hold Aviva (AV.) by Simon Watkins in The Motley Fool

- Buy Phoenix Group Holdings (PHNX) by Simon Watkins in The Motley Fool

- Hold Unilever (ULVR) by Deutsche Bank

- Buy Experian (EXPN) by Goldman Sachs

- Neutral GSK (GSK) by Citi

- Overweight Auction Technology Group (ATG) by JP Morgan

- Buy Ibstock (IBST) by Jefferies

- Buy Forterra (FORT) by Jefferies

- Buy Dunelm Group (DNLM) by Jefferies

- Hold Greggs (GRG) by Jefferies

- Add Diageo (DGE) by Stephen Wright in The Motley Fool

- Add LondonMetric Property (LMP) by Zaven Boyrazian in The Motley Fool

- Add Prudential (PRU) by Andrew Mackie in The Motley Fool

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Buy Vodafone Group (VOD) by LBBW

- Neutral Linde (0M2B) by JP Morgan

- Neutral Airtel Africa (AAF) by Citi

Contrasting Fortunes for Greggs and Thomas Cook

A number of trading updates caught the eye this week, but perhaps none more so than Greggs (GRG) and Thomas Cook (TCG). In terms of market reception, the two couldn’t be more different; while shares in Greggs soared, the price of Thomas Cook shares plummeted. In this week’s issue we cover current tipster and broker sentiment towards both UK firms.

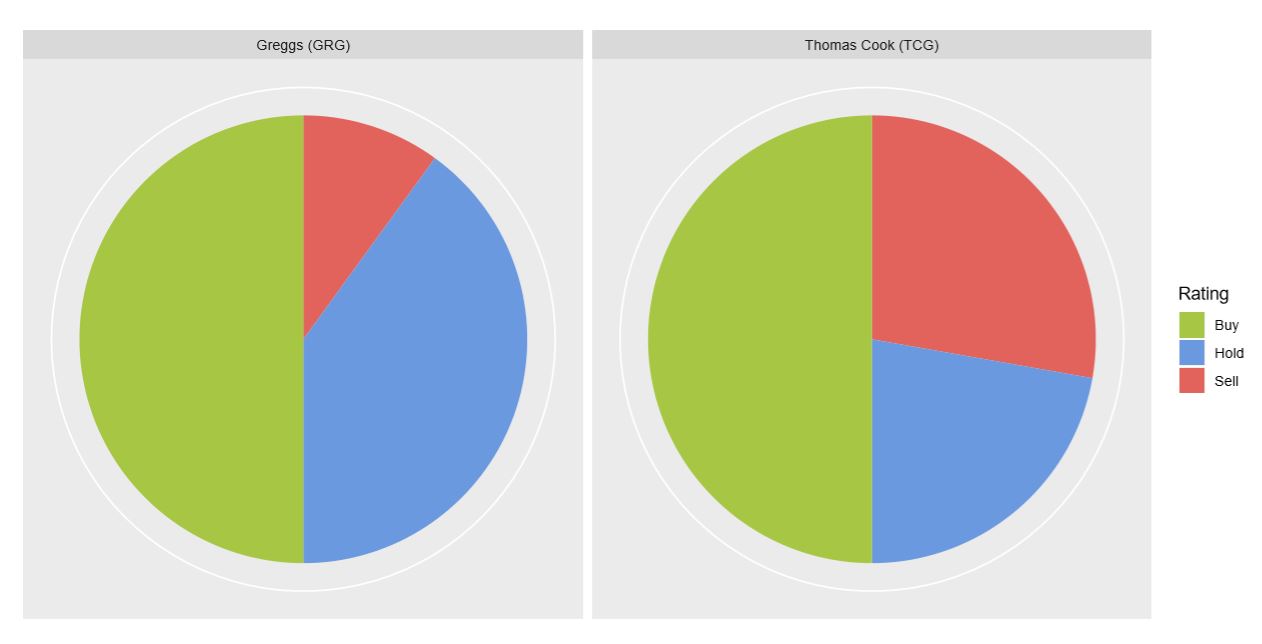

Greggs (GRG) and Thomas Cook (TCG): Broker and Tipster Sentiment (Last Six Months)

Greggs PLC (GRG)

Tip Sentiment (Last Six Months): 50.00% Buy, 40.00% Hold, 10.00% Sell

Holders of baked goods retailer Greggs (GRG) endured a torrid first six months of the year. Shares were at an all-time high of nearly 1400p at the end of 2017, but by July had sunk closer to 950p after profit warnings in the spring. However, a welcome resurgence following more recent positive trading updates has seen the share price recover, and shareholders will be relieved to see positive YTD performance for the first time this year. The most recent trading update bucked the trend of recent downbeat high-street earnings announcements; boasting a boost in sales of 9% and an increase in expected full-year profits before tax to £86m from £81m back in July. Shares responded accordingly and are up 13.5% for the week so far.

Tipster sentiment has been high in recent weeks; Roland Head, GA Chester and Rupert Hargreaves (The Motley Fool) have all tipped the shares as a buy. Roland Head considers the company one “you can safely buy and forget for ten years” and cites the baker’s “impressive return on capital employed last year” (23%). In October, Rupert Hargreaves noted that the “forward P/E ratio of 17 isn’t cheap…but when you take into account the group’s dominance of the UK high street, I think this is a price worth paying”. Brokers have taken a more cautious stance towards the firm’s prospects of late, with Canaccord Genuity, Peel Hunt and Shore Capital all reiterating hold ratings in the last week.

Thomas Cook Group (TCG)

Tip Sentiment (Last Six Months): 50.00% Buy, 22.20% Hold, 27.80% Sell; Share Price +0.4% in last 7 days

In contrast to Greggs, Thomas Cook shares remained relatively stable at the beginning of the year and even generated a positive return; starting 2018 at 124.7p and hovering above 146p in May. However, things have since gone rapidly downhill during a turbulent period in which the travel provider released a profit warning, with shares now trading at 32.3p - representing a drop of over 77% from that high in May. The company swung to a loss in its full year results – released on 29th November – although the bad news had already been disseminated to the market two days earlier. Although the company board were praised in some quarters for their honesty and transparency in releasing an early warning ahead of full-year results, it wasn’t enough to prevent investors from fleeing, with shares down almost 30% for the week.

Whereas tipsters were mostly positive about Greggs, they are divided about the future of Thomas Cook. Chris Bailey (ShareProphets), Rupert Hargreaves (The Motley Fool) and Times Tempus (The Times) have all considered the shares to be a buy in recent weeks. However, Roland Head (The Motley Fool) and Miles Costello (The Times) have advised potential investors to steer clear. Although Miles Costello concedes that “the company is operating well in areas it can control” he considers “too much of its fate is outside of its hands”. Roland Head bases his ‘avoid’ recommendation on Thomas Cook’s “sharply increasing debt levels and uncertain outlook”. However, a Times Tempus article this week struck a more optimistic chord, believing that the company’s management won’t make the same mistakes again, and adding that “the shares are down 72 per cent…over the past year, suggesting it might go bust. It won’t”. Elsewhere, broker Shore Capital reiterated its hold rating.

There are now over 45,000 tips on our platform, all performance-tracked and available to view. Sign up to Stockomendation now and take a look for yourself – it’s free!

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 30th November 2018.