Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Add Diageo (DGE) by Stephen Wright in The Motley Fool

- Add LondonMetric Property (LMP) by Zaven Boyrazian in The Motley Fool

- Add Prudential (PRU) by Andrew Mackie in The Motley Fool

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

Two companies that tipsters and brokers are avoiding in 2018

Last month Stockomendation reviewed the companies with perfect broker and tipster ‘buy’ ratings so far in 2018. This week, we take a look at the opposite side of the spectrum, and identify the two companies with the highest proportion of ‘Sell’ or ‘Avoid’ tips so far this year.

Telit Communications (TCM)

31 tips in 2018; 100% Sell

In terms of share price performance, Telit Communications share price has had a decent run in 2018 so far; shares have risen 6.7% while the AIM All-Share index is up 4.3% over the same period. This will offer little consolation for long term holders of Telit, however, considering that the shares were trading at more than twice the current price back in May 2017. The firm – an Internet of Things (IoT) enabler – was famously rocked last year when it’s profits collapsed and an independent review revealed chief executive Oozi Cats’ had concealed a US indictment against him.

Since then, a “turnaround plan” announced by the company has failed to convince the tipster community, and the drama continues, with Telit announcing Director and CEO Yosi Fait has stepped down with immediate effect on 21st September. ShareProphets’ tipster Lucian Miers maintains a short position, noting that the company “seems incapable of generating cash”, while The Motley Fool’s GA Chester – who had previously warned of “aggressive accounting at Telit” – remains unimpressed with the most recent accounts. Tipsters such as Tom Winnifrith, Alan Oscroft and Nigel Somerville have also recently issued ‘Sell’ ratings on Telit.

Telit Communications (TCM) Performance YTD

Pearson (PSON)

40 tips in 2018; 80% Sell

While Telit’s sell tips were contributed entirely by tipsters, a majority of Pearson’s ratings were made by brokers. Berenberg, Liberum Capital, Deutsche Bank and Numis have all rated the company as a ‘sell’ so far in 2018, despite the educational publishers own turnaround story; back in February it announced annual profits of £421m versus a record loss of £2.6bn in the previous year. Royston Wild remained unconvinced at the time, citing a forward P/E ratio of 14.1 which “does not reflect the hard yards it still has to make to generate meaningful earnings growth”. The Telegraph’s Russ Mould agreed on the basis that “the company grapples with falling student numbers, the rising use of print rental and the threat posed by disruptive technological change”.

There still remains some appetite for Pearson shares, however. Malcolm Stacey offers a contrarian “buy” rating, noting that the publishers switch to e-publishing appears to be paying off and is therefore “foresighted enough to invest in the technological wave…and the gamble is likely to come off”. Shares in Pearson are up 17.6% since the beginning of the year.

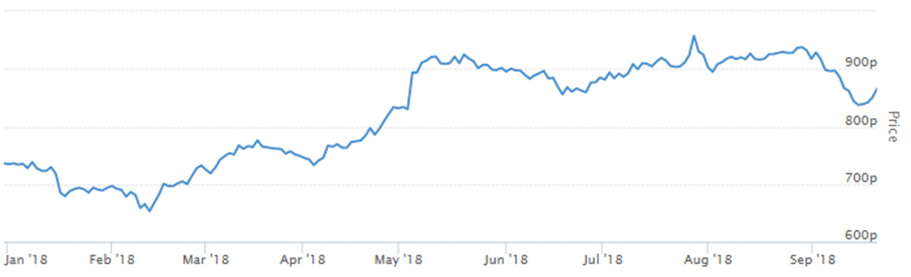

Pearson (PSON) Performance YTD

You can track up-to-date tipster and broker sentiment at Stockomendation. Our current platform allows you to performance-track over 40,000 stock tips from over 330 tipsters and brokers. Sign up now and take a look for yourself – it’s FREE!

Disclaimer: The contents of this article should not be considered financial advice. Data accurate as at 21st September 2018. Companies identified are those with at least 20 tips so far in 2018, with the highest proportion of ‘Sell’ or ‘Avoid’ ratings.