Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Three Shares With Perfect Tipster Ratings in 2018

B&M European Value Retail S.A. (BME)

29 tips in 2018; 100% Buy

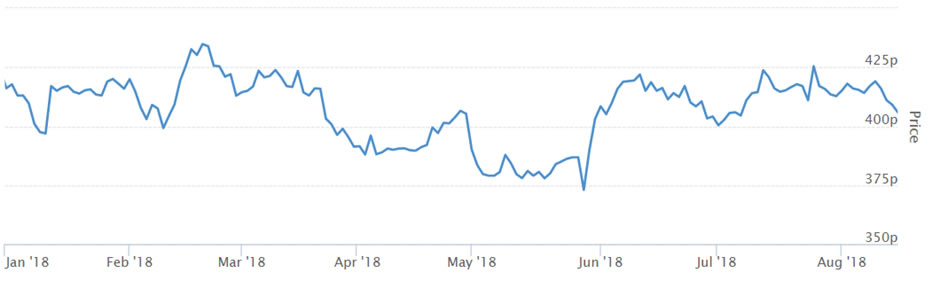

While the outlook for the retail sector has been particularly glum recently, this discount retailer has consistently remained something of a “darling stock” for brokers and tipsters, with all but two ratings being anything other than a ‘Buy’ since late-2014. It’s been a case of business as usual so far this year too, with the company awarded a ‘Buy’ rating on 29 occasions since the start of the year.

The firm’s share price has recovered after poor performance earlier in the summer, and it now trades at roughly the same level as they were at the start of the year. Despite trading at a “lofty valuation” (P/E Ratio = 21.8), Ian Pierce at the Motley Fool points to “weak consumer confidence and dismal wage growth” as a reason for optimism amongst discount retailers. Peter Stephens also remained positive, noting a “forecast rise in earnings of 13% in each of the next two financial years”, while back in May Rupert Hargreaves considered the firm to have strong dividend growth potential.

B&M European Value Retail S.A. (BME)

The Gym Group (GYM)

27 tips in 2018; 100% Buy

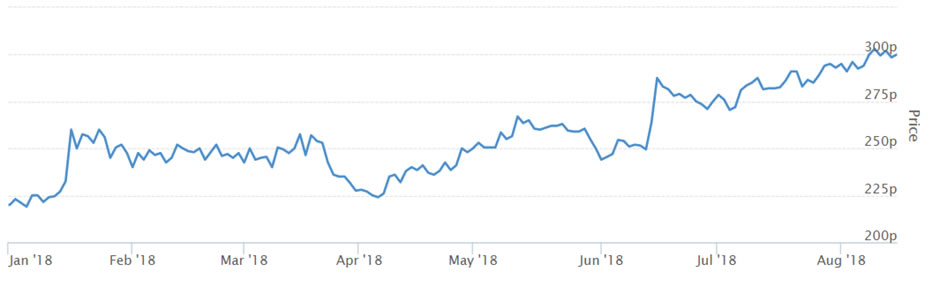

It’s been a great year to be a shareholder of this budget fitness club chain, with shares trading at approximately 300p – up 36.4% since the start of the year. Positive full year results, including a 23% increase in earnings, announced earlier in the year contributed to a flurry of positive research notes over the spring, and that momentum has carried through the summer, with the firm commanding a hefty market capitalisation of over £400 million.

With interim results for the six-month period ending 30th June 2018 due to be posted later this month, Royston Wild at The Motley Fool considers it time for “savvy investors [to] consider snapping the stock up…”, with “city analysts expecting the firm’s earnings to leap 25% and 38% in 2018 and 2019 respectively”. Gym Group also appeared as a ‘Buy’ in both The Guardian and Times Tempus at the beginning of the year.

The Gym Group (GYM)

TT Electronics (TTG)

22 tips in 2018; 100% Buy

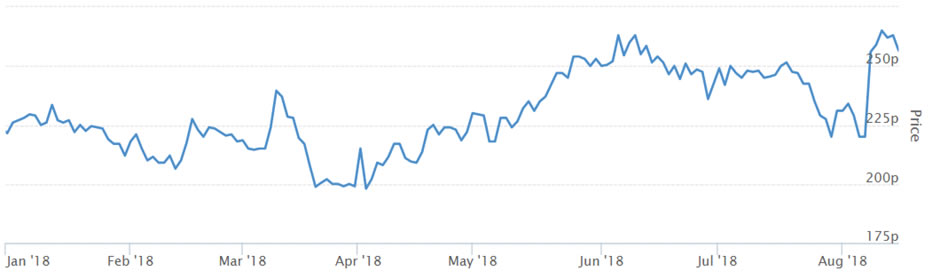

It’s been an up and down year for shareholders of this electronic components manufacturer, which has undergone significant changes in recent months. After beginning the year at 221.50p, shares slumped to below 200p in March before rallying to a new high of 265p this month. The most recent interim results, indicating 12% revenue growth relative to the same period in 2017, were widely taken as positive news with an influx of broker ratings in recent weeks, and the company appears to have benefitted from selling its transportation division last year, using the cash generated from the sale – and some debt financing – to acquire Stadium Group and Precision Inc. Its current market capitalisation lies at approximately £430 million.

Alongside ‘Buy’ ratings from brokers such as Berenberg, Numis, Liberum and Peel Hunt, tipster Roland Head considered the firm to be a “long-term buy” earlier this year, citing the group’s stable profits and potential for cost savings”.

TT Electronics (TTG)

Our current platform allows you to performance-track over 40,000 stock tips from over 330 tipsters and brokers. Sign up now and take a look for yourself – it’s FREE!

Disclaimer: The contents of this article should not be considered financial advice. Data accurate as at 15th August 2018..