Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Avoid Warpaint London (W7L) by Steve Moore in ShareProphets

- Buy Vodafone Group (VOD) by DZ Bank

- Watch Mony Group (MONY) by Simon Watkins in The Motley Fool

- Add BP (BP.) by Andrew Mackie in The Motley Fool

- Buy Taylor Wimpey (TW.) by Simon Watkins in The Motley Fool

- Reduce Safestore Holdings (SAFE) by Kepler Cheuvreux

- Add S&U (SUS) by Peel Hunt

- Buy Mitchells & Butlers (MAB) by Deutsche Bank

- Sell Croda International (CRDA) by Goldman Sachs

- Neutral Rio Tinto (RIO) by UBS

- Neutral Rio Tinto (RIO) by Citi

- Buy Antofagasta (ANTO) by Citi

- Buy Glencore (GLEN) by Citi

- Neutral LondonMetric Property (LMP) by Goldman Sachs

- Neutral Drax Group (DRX) by Goldman Sachs

- Outperform Serco Group (SRP) by RBC Capital

- Equal Weight Safestore Holdings (SAFE) by Barclays

- Overweight Big Yellow Group (BYG) by Barclays

- Buy Legal & General Group (LGEN) by Berenberg

- Overweight Croda International (CRDA) by JP Morgan

Month in Review: October 2018

Tipster sentiment spiked as tipsters saw buying opportunities in the wake of an October sell-off. Earlier this month Roland Head at the Motley Fool wrote “we’re interested in gaining an advantage over the market, not following the crowd”, and as key UK indices dropped over 5% this month tipsters were drawn to undervalued companies.

Though the proportion of sell ratings from tipsters only dropped slightly to 22.1% (from 25.5% in September), the proportion of buy tips from tipsters jumped from 61.5% in September to 71.5% this month. Meanwhile, broker sentiment decreased slightly; buy ratings accounted for 69.3% of all broker tips in October, down from 72.9% in September, while sell ratings increased marginally from 4.4% to 5.6%.

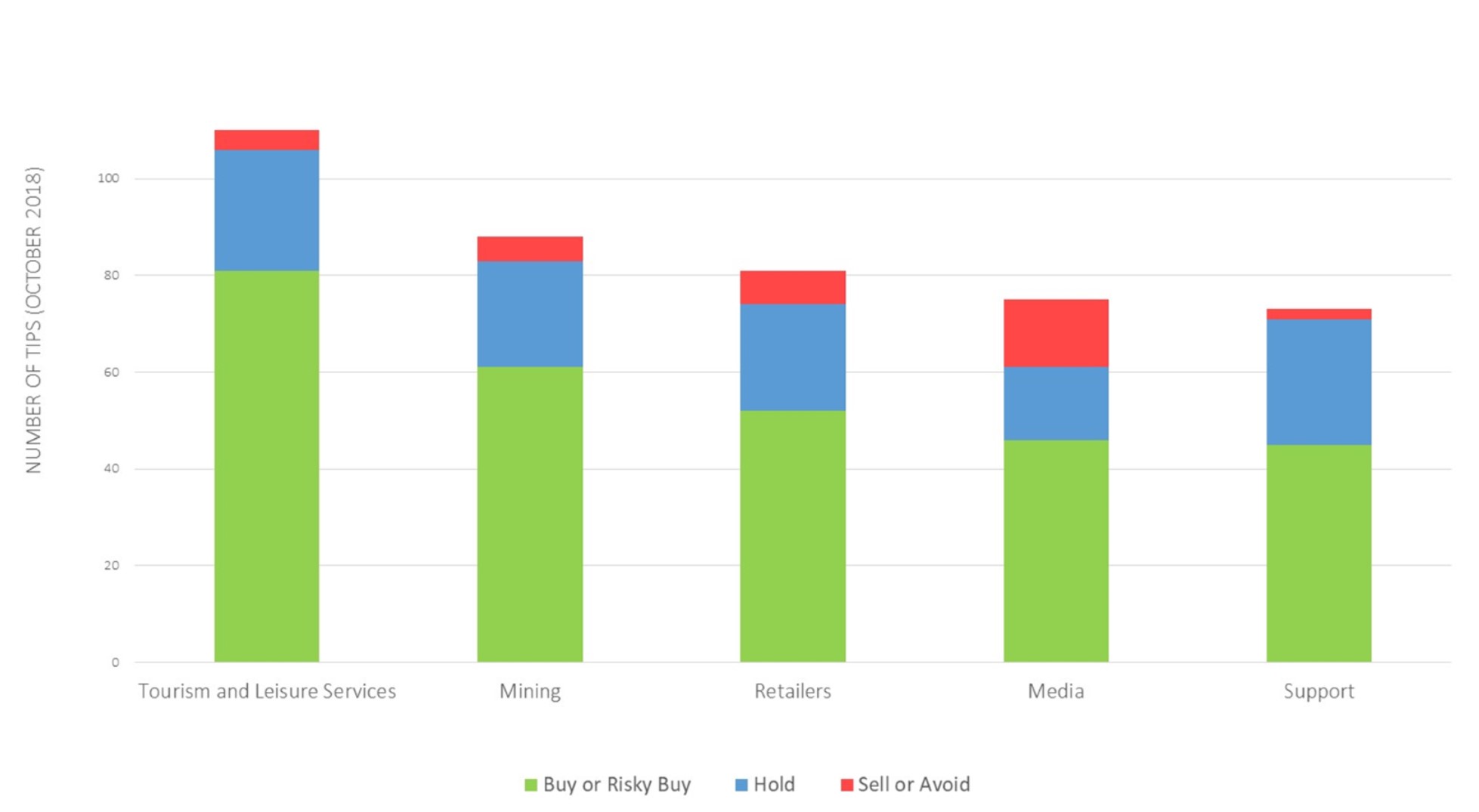

Brokers were once again most active in Tourism and Leisure Services...

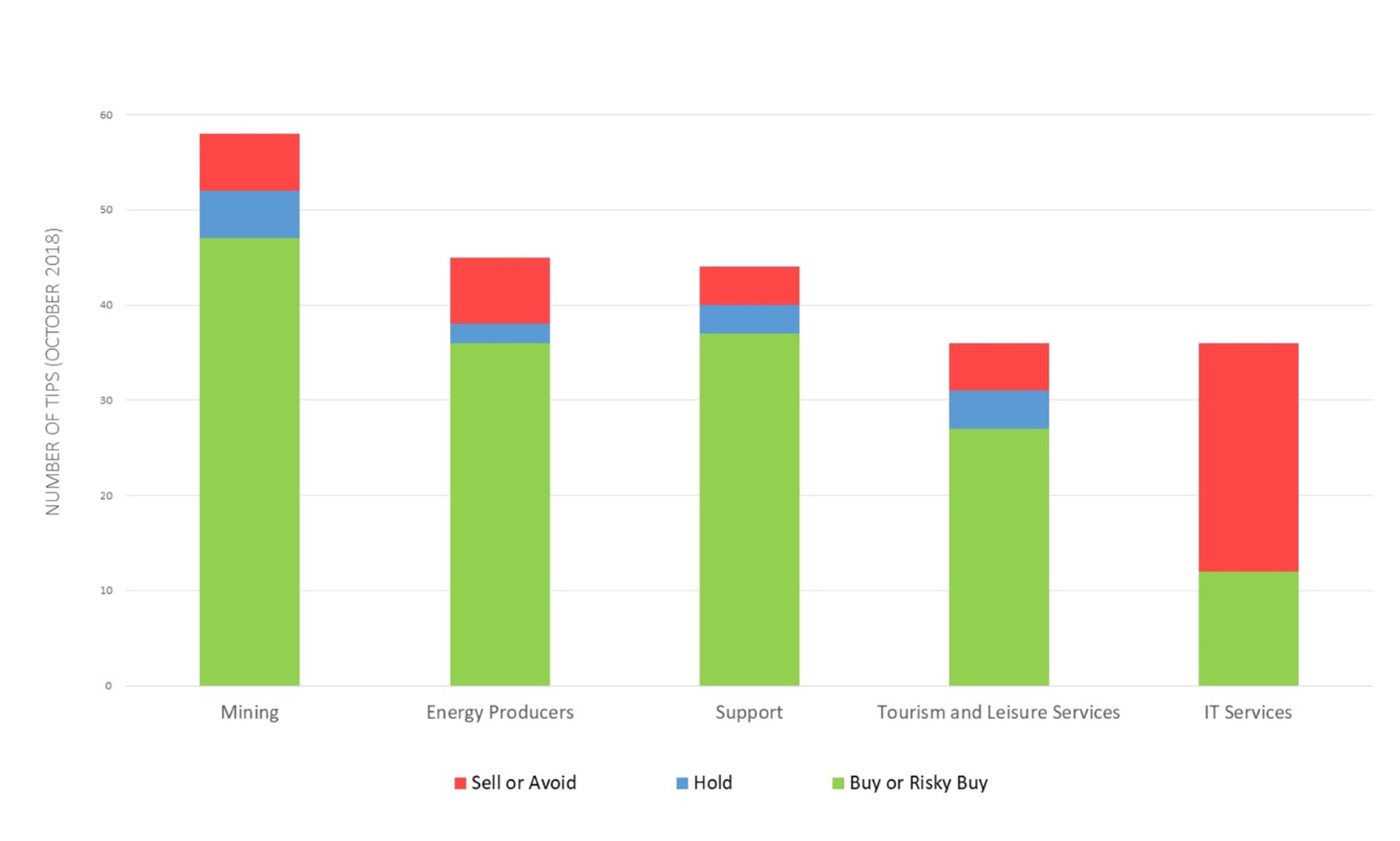

...while tipsters switched focus back to Mining and Energy Producers

There was a shake-up in the most hotly-tipped sectors for brokers and tipsters. Broker focus in mining firms surged, due in part to an influx of tips on Antofagasta (ANTO). The company’s production update announced last week was received negatively by brokers, with over half slapping ‘sell’ ratings on the mining firm. Tipsters were once again most active in the mining sector, although IT Services made in into the top five hotly-tipped sectors following reiterated ‘sell’ tips by ShareProphets tipsters Tom Winnifrith and Lucian Miers on First Derivatives (FDP).

Brokers performed particularly well in the Household Goods sector (average performance of +4.9% from 50 tips); due in part to ‘buy’ ratings by brokers – such as UBS and Berenberg – made on Crest Nicholson Holdings (CRST) earlier this month. However, broker ratings for Manufacturing (-5.9% from 7 tips) firms performed poorly ,mainly due to new ‘hold’ tips on Low & Bonar (LWB) – who shares have been sliding since it announced a profit warning at the end of September – and Vesuvius (VSVS).

Tipsters saw success in the Electronic & Electrical Equipment sector, with an average performance of +9.0% from 7 tips in the sector, helped to a large degree by Steve Moore’s (ShareProphets) tip to sell Photonstar LED Group (PSL); a poorly-received trading update at the end of the month has resulted in the firm’s shares plummeting 68.4%. This tip was narrowly outperformed by Tom Winnifrith’s tip to sell MySquar Limited (MYSQ) – which was October’s top performer – producing performance of over 68.9%. The top ‘buy’ tip for the month was Peel Hunt’s buy rating on Serica Energy (SQZ), which achieved performance of 43.51%.

Finally, the most-frequently tipped companies differed between tipsters and brokers in October. WPP (WPP) attracted the highest number of broker ratings (16 tips) as shares in the firm sunk during the course of the month, while Lloyds Banking Group (LLOY) – which was featured in the most recent Stockomendation blog last week – was the most frequently tipped company amongst tipsters (9 tips).

Tip activity on the whole was up for the month due to a number of big-name trading updates; over 1,700 tips were added to the Stockomendation platform in October, an increase of nearly 400 on the previous month.

There are now over 40,000 tips on our platform, all performance-tracked and available to view. Sign up to Stockomendation now and take a look for yourself – it’s free!

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 2nd November 2018.