Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Sell World Chess (CHSS) by Steve Moore in ShareProphets

- Avoid Trifast (TRI) by Steve Moore in ShareProphets

- Avoid The Magnum Ice Cream Company (MICC) by Steve Moore in ShareProphets

- Buy Relx plc (REL) by Bank of America

- Buy South32 Limited (DI) (S32) by UBS

- Buy Weir Group (WEIR) by UBS

- Buy Relx plc (REL) by UBS

- Avoid Iomart Group (IOM) by Steve Moore in ShareProphets

- Buy Halma (HLMA) by Goldman Sachs

- Sell Ashmore Group (ASHM) by Deutsche Bank

- Hold Mondi (MNDI) by Deutsche Bank

- Hold Schroders (SDR) by Deutsche Bank

- Buy Relx plc (REL) by Deutsche Bank

- Buy Morgan Sindall Group (MGNS) by Deutsche Bank

- Hold GSK (GSK) by Deutsche Bank

- Overweight Unilever (ULVR) by Barclays

- Buy Morgan Sindall Group (MGNS) by Berenberg

- Outperform Rathbones Group (RAT) by RBC Capital

- Overweight Relx plc (REL) by Barclays

- Outperform Relx plc (REL) by Bernstein

Third Quarter Trading Updates Spur Tipster Focus on the Banking Sector

Despite a series of strong earnings announcements, it’s been a disappointing few months for holders of London-listed bank shares. Tip activity spiked in the banking sector this week, spurred on by third quarter results announced by Lloyds Banking Group (LLOY) and Barclays (BARC) in recent days. This week, we take a look at recent tip activity in the sector, and see how tipster sentiment towards banking firms currently differs from brokers.

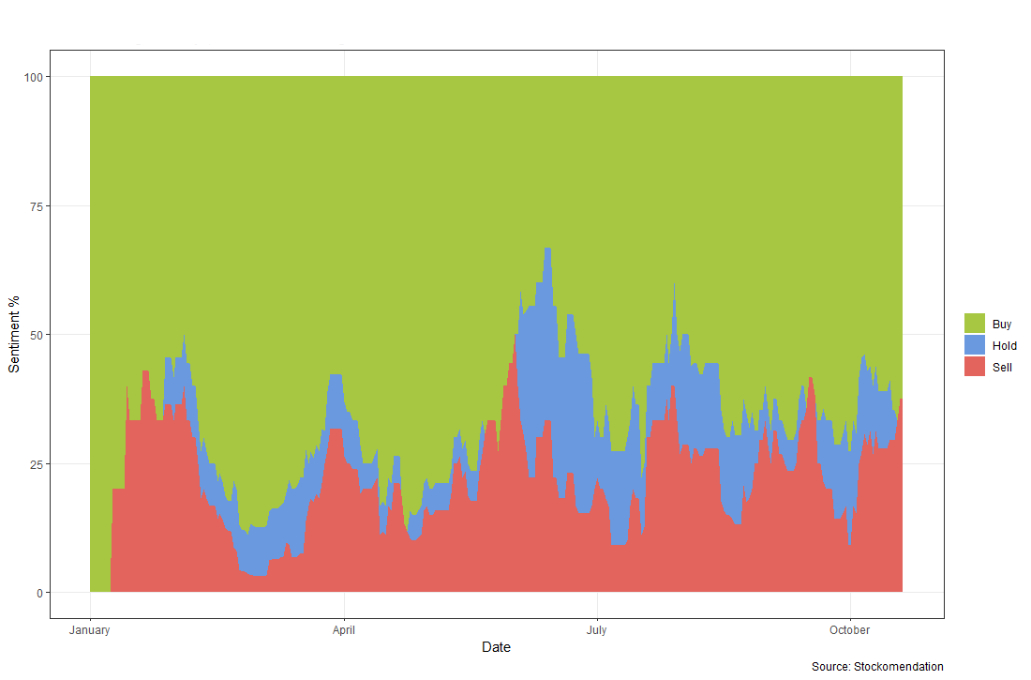

Banking Sector Tipster Sentiment in 2018

4-Week Rolling % of Buys, Holds and Sells Ratings

Lloyds hit the news earlier this week when it announced a strategic joint venture with Schroders (SDR) – ranking amongst the largest ever wealth management alliances – and followed that up by beating forecasts in its interim results on Thursday. Whereas the news was received well by brokers – all five brokers reiterated buy ratings on Lloyds’ shares – tipsters remained much less optimistic.

Richard Evans (The Telegraph) advised readers to hold, noting that “every important number reflected continued improvement”. However, both GA Chester (The Motley Fool) and Katherine Griffiths (The Times) warned readers to avoid, with the latter concerned about its “limited ways to boost growth” now that it has resolved the “big problems of the past decade”. Chris Bailey (ShareProphets) reiterated his earlier recommendation of buying “with the hope of a 70p share price and a bit of dividend income to boot by some next year”.

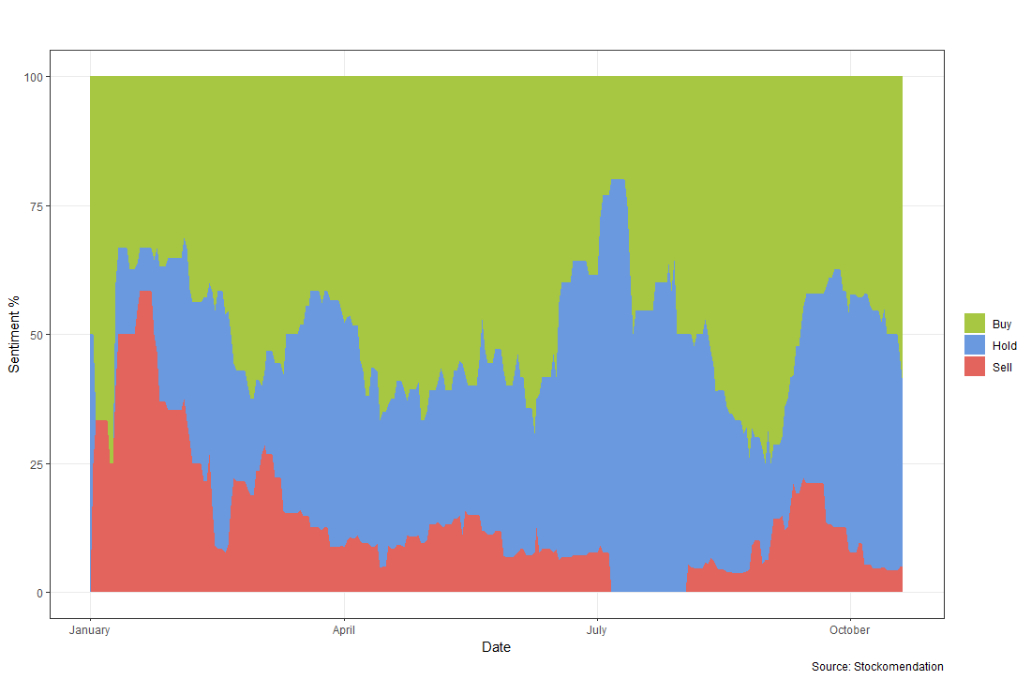

Banking Sector Broker Sentiment in 2018

4-Week Rolling % of Buys, Holds and Sells Ratings

Shares in Barclays are currently hovering over 3.5% higher than they closed last week, after it announced third quarter results on Wednesday. Pre-tax profits dropped from £3.5bn to £3.1bn compared to the same period last year, but this was impacted by over £2bn in fines and charges. Similar to Lloyds, five brokers covering the shares all issued buy ratings, while tipsters were more concerned. Roland Head (The Motley Fool) is bullish, finding that “using most common measures of value, Barclays shares look attractive”. Kevin Godbold (The Motley Fool) disagrees however, citing “more downside risk than upside potential with the big London-listed bank shares”.

The top performers in the sector this month came from broker recommendations on Secure Trust Bank (STB). A third quarter trading update on 17th October led to buy ratings from Canaccord Genuity, Peel Hunt and Shore Capital; all three have achieved performances of nearly 5%. In contrast, CYBG’s (CYBG) recent woes have seen ‘hold’ ratings made towards the company’s shares produce negative performance of over -17%.

There are now over 40,000 tips on our platform, all performance-tracked and available to view. Sign up to Stockomendation now and take a look for yourself – it’s free!

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 26th October 2018.