Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Next and Staffline under the spotlight next week

Ahead of a more comprehensive review of annual broker and tipster activity next week, this week’s article focuses on two expected early-January trading announcements from Next (NXT) and Staffline (STAF). Strong returns on Next shares were wiped out during a disappointing second half to the year, while shareholders of Staffline will be happy with a return of over 20% in 2018. Given economic uncertainty and the recent woes of big name retailers both updates will be seen as important early indicators for their respective sectors. Are brokers and tipsters bullish about both companies’ future prospects?

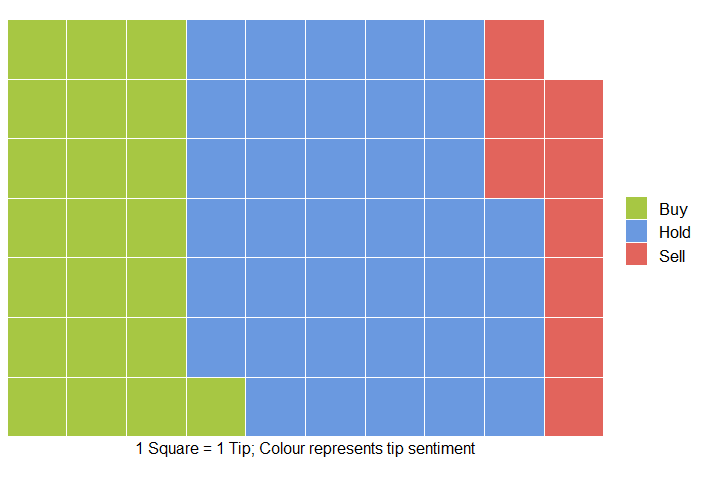

Next PLC (NXT) Broker and Tipster Sentiment in 2018

With nearly 70 tips on Next shares tracked by Stockomendation in 2018, the fashion retailer has proven to be one of the more frequently-tipped UK firms. As can be seen from the chart above, opinion is mixed; 32% of tips recommend the shares as a buy compared to 13% as a sell. What’s perhaps more telling is the proportion of hold ratings (55%). As we have seen in previous articles, such as our coverage of Interserve two weeks ago, broker ratings are typically bullish. Considering the high level of broker coverage that Next receives, the discovery that a large number rate the company as a hold means that brokers are sceptical about the ability for Next to generate positive returns in the coming months. Brokers such as Jefferies, Liberum Capital, Peel Hunt and Shore Capital all offer hold ratings, while UBS and HSBC maintain buy ratings.

Tipster outlook has also been mixed over the last year. Most recently, GA Chester (The Motley Fool) advised readers to avoid the shares, predicting that “there are signs consumers are finally starting to make a long-overdue cutback in their discretionary spending….I think this could show up in Next’s Christmas trading update on 3 January”. Roland Head (The Motley Fool) considers Next to be “one of my top FTSE 100 buys” adding that “the shares have a forecast price/earnings ratio of around 10 and a dividend yield of 3.5%....that looks like good value”. Richard Evans (Telegraph Questor) recommends readers to hold but strikes a positive tone, expressing confidence about “Next’s status as a reliable income producer”.

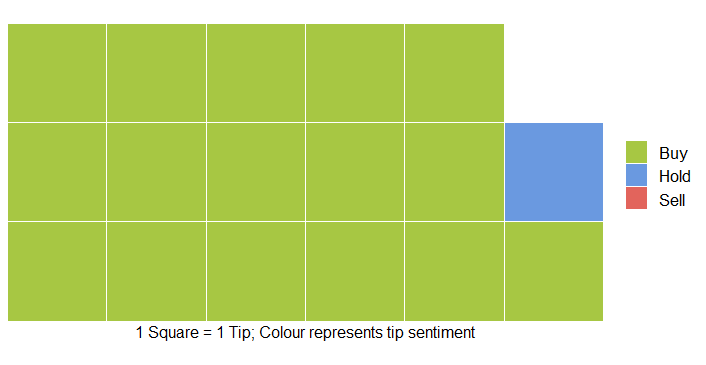

Staffline (STAF) Broker and Tipster Sentiment in 2018

Staffline has had considerably less coverage this week – a majority of tips through the year came from Liberum Capital and were consistently positive. However, tipsters were also mainly positive on the stock during the course of the year. Malcolm Stacey (ShareProphets) considered the shares to be a buy earlier in the year, noting that “this growing giant could be just the job for a new opening in your portfolio”. Peter Stephens (The Motley Fool) agrees, and sees the shares as “offering the potential for rapid dividend growth. However, Richard Evans (Telegraph Questor) takes a more cautious stance with a hold rating, but notes that “the firm is in a position to grow earnings when the employability business is past the current uncertainty and those earnings may be of a higher quality”.

There are now over 45,000 tips on our platform, all performance-tracked and available to view. Sign up to Stockomendation now and take a look for yourself – it’s free!

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 24th December 2018.