Another dismal year for public services provider Interserve (IRV) was capped off by a further 50% slump in the firm’s share price earlier this week. The price reaction formed a direct response to the revelation that Interserve is seeking a rescue deal which – according to Christopher Williams (The Telegraph) – represents “a disaster for shareholders”. In this week’s article, we take a look at current tip sentiment; do the consensus believe the firm now can be salvaged, or is it is doomed to fail? The answer: it depends on who you ask – tipsters, or brokers?

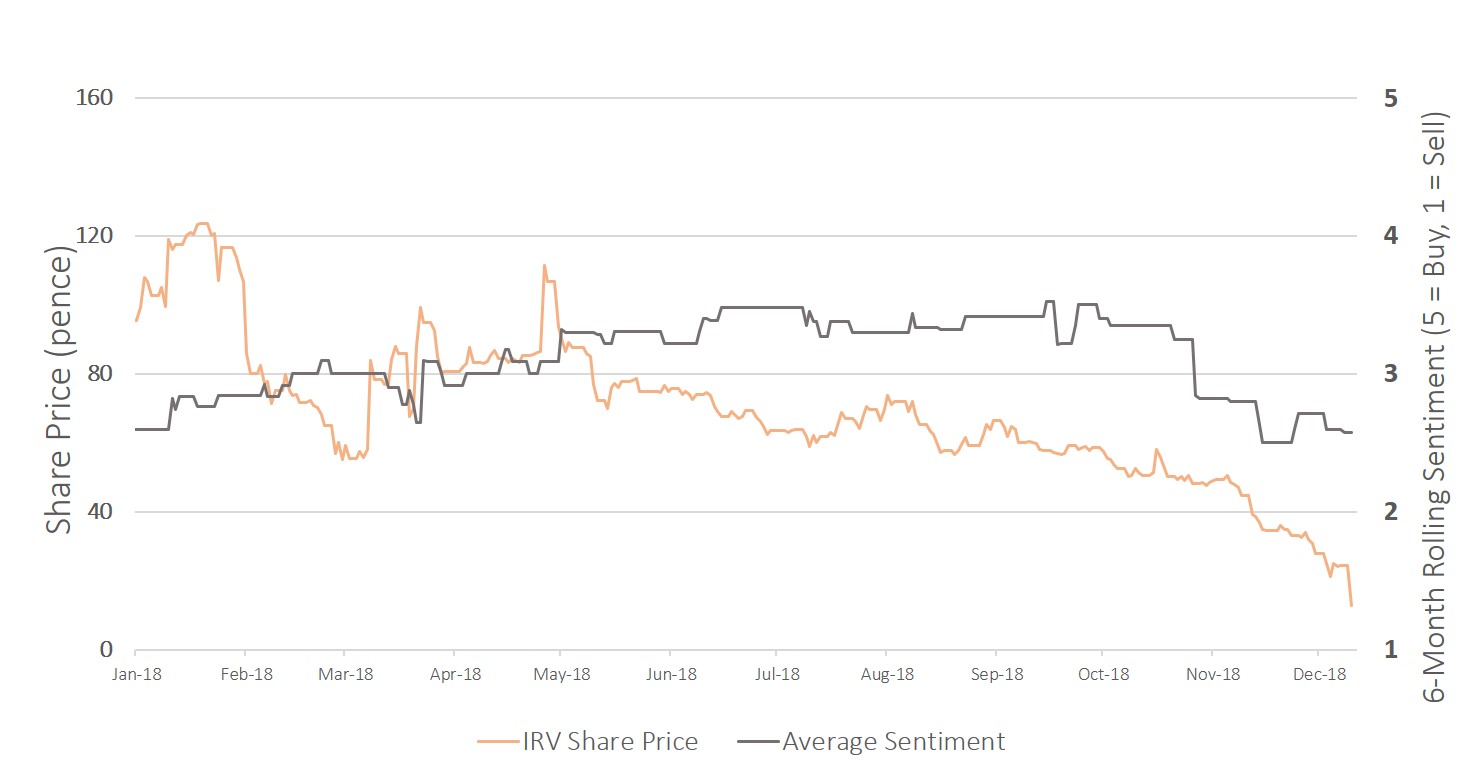

Interserve (IRV): Share Price & Sentiment in 2018

Overall consensus sentiment towards Interserve (on a six-month rolling basis) currently stands in ‘sell territory’, although average sentiment is much more bearish when only tipster sentiment is taken into account. It is no surprise to see sentiment so low: Interserve shares are down over 86% since the beginning of the year, and 93% since chief executive Debbie White took the reins back in September 2017. Following Sunday’s announcement - which warned of a “material dilution for Interserve shareholders” – the firm commanded a market capitalisation of less than £20 million, while total debt is expected to hit as much as £650 for the current financial year. For tipsters, those numbers make for grim reading; Nigel Somerville (ShareProphets) – who first tipped Interserve as a sell back in October last year when the shares traded at 106p – noted last week that any debt-for-equity swap “would have to be attractive enough to the lenders to gain support, and that, to my mind, leaves shareholders in line to be completely spanked”. Fellow ShareProphets author Steve Moore concurs and last month also rated the company as a sell.

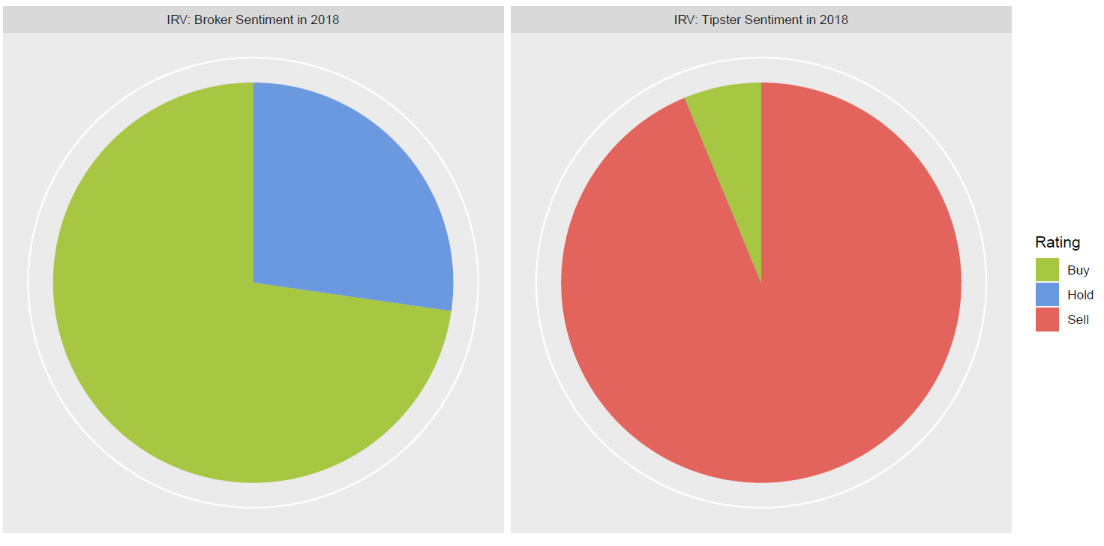

Elsewhere, Motley Fool tipster Roland Head advised readers to avoid Interserve shares back in October, noting the firm’s high debt level of 6 times trailing earnings, and a 2019 P/E ratio of 3. The tipster also adds that “in my opinion this indicates that the market doesn’t expect Interserve to deliver a sustainable recovery without raising fresh cash and diluting shareholders”. Robert Lea (The Times) agrees, recommending that readers avoid due to “a mountain of debt and unforgiving markets”. Of the sixteen tips from tipsters which have been performance-tracked by Stockomendation so far in 2018, only one has struck a positive tone, with the other fifteen all recommending investors to sell or avoid.

Brokers on the other hand have been much more generous, and this is perhaps no surprise given the buy-side bias that typify broker recommendations; of the twenty-two broker tracked by Stockomendation in 2018; sixteen were positive buy ratings and six were neutral holds. Last Month, Peel Hunt tipped the public services provider as a buy with an accompanying target price of 100p. Numis and Stifel have also published buy ratings earlier in the year, while Berenberg reiterated a hold rating back in March and Liberum Capital last month reiterated a hold rating with a target price of 35p, having downgraded from a buy back in May.

There are now over 45,000 tips on our platform, all performance-tracked and available to view. Sign up to Stockomendation now and take a look for yourself – it’s free!

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 10th December 2018.