Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Recapping The Week For Housebuilders

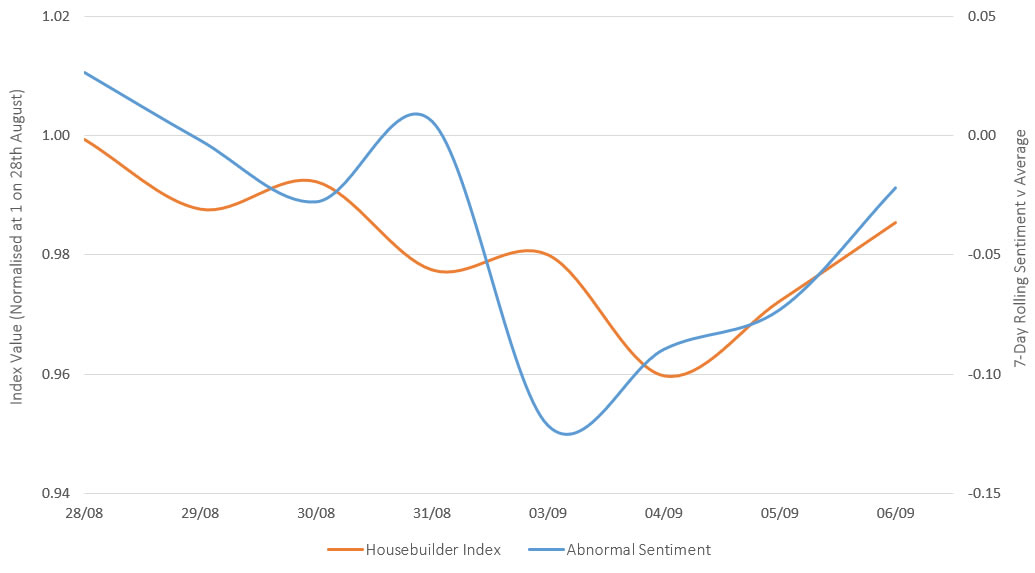

It’s been an eventful few days for UK house builders, with numerous earnings announcements over the last week coinciding with speculation about the future of the Government’s flagship ‘Help to Buy’ subsidy scheme. As a result, we’ve seen daily returns and sentiment levels in the sector fluctuate more than usual over the course of the week. This week’s chart shows abnormal tipster and broker sentiment levels (above/below the 6-week average) towards a portfolio of eleven house builders over the last few days. It also shows returns for the same companies over the same period.

The biggest movement in sentiment occurred on 3rd September, which coincided with Shore Capital reiterating its ‘Hold’ stance towards Redrow (RDW) and Barratt Developments (BDEV), and a ‘Sell’ stance on Bovis Homes (BVS). Redrow then went on to announce a 21% rise in pre-tax profits on the year to June, while company chairman Steve Morgan also bringing the Help to Buy scheme to the fore once more by calling for clarity on the future of the scheme. Nearly 40% of Redrow’s private reservations were supported by Help to Buy in the year to June. While Redrow’s positive results resulted in a recovery of tipster and broker sentiment in the sentiment (mainly driven by brokers rating the company as a buy), the share prices of other largebuilders such as Persimmon (PSN) took a hit, bringing the index value down for the day.

Housebuilders: Share Price v Abnormal Sentiment Levels

Both sentiment and share prices recovered considerably on Wednesday. Barratt Developments (BDEV) reported a 9.2% increase in pre-tax profits the following day (5th) as the Home Builders Federation announced ‘Help to Buy’ to be a “mitigated success”. A report by the federation showed that the number of homes built annually increased by 74% since it was introduced in 2013. Similar to Redrow, over 40% of Barratt’s sales were supported by Help to Buy. Berkeley Group Holdings (BGH) shot out a gloomier outlook on property development in London though, reporting that the market had stalled amid a lack of urgency. Buy ratings towards both companies by broker Peel Hunt contributed to more positive sentiment in the sector. Meanwhile, commentators such as Ben Marlow in the Telegraph criticised Help to Buy as being “help for house builders”.

Bovis Homes and McCarthy & Stone (MCS) capped off the flurry of earnings announcements, as Bovis’ interim showed a 41% increase in profits. McCarthy and stone, on the other hand, reported that 2018 would be a ‘tough year’. Operating profits for the year ending August are likely to be at least 24% lower than the previous year. As a retirement housebuilder, the firm does not benefit from the Help to Buy scheme like its peers. Elsewhere, tipster Rupert Hargreaves was bullish on Galliford Try (GFRD), seeing potential for a re-rate as confidence returns, and citing both the company’s dividend yield of 7.1% and forward P/E ratio of 7.1. Both sentiment levels and the index value of eleven housebuilders finished higher towards the end of play on Thursday.

Our current platform allows you to performance-track over 40,000 stock tips from over 330 tipsters and brokers. Sign up now and take a look for yourself – it’s FREE!

Disclaimer: The contents of this article should not be considered financial advice. Data accurate as of 6th September 2018.