Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Trading Signals Third Quarter Review

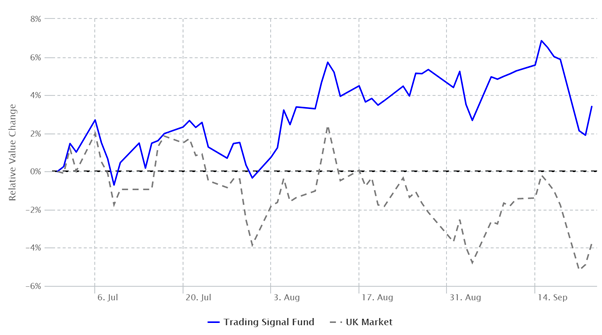

The 3rd quarter of 2020 has seen a slow decline in UK markets, as they are currently down -3.8% below the start of the quarter.

However, Stockomendation’s Trading Signal service, which identifies the top market signals from the UK’s best Stock Pickers, Tipsters and Brokers, has seen another remarkable quarter outperforming the market by 7.2%.

Third Quarter Performances

The service has so far identified 42 new buy Trading Signals over the course of the third quarter. So, if you are a subscriber then please keep an eye out for your email alert with the next generated signal. If you are not a subscriber then you can sign up here.

Below we take a look at some of the Trading Signals identified by our quantitative analytics engine this quarter:

Our engine identified a Buy signal issued on Persimmon (PSN) on the 8th July at a price of 2,416p. News was then received on the 9th that sales on homes had returned to pre-covid levels. They continued to rise and the signal closed up 13% on the 18th August.

Next up was a Buy signal on Avon Rubber (AVON) on the 13th July at a price of 3,740p. This came following a decision to sell off its Dairy Business for €200m on the 8th July to focus on defence and was quickly followed by news that it had secured a lucrative US defence contract. The signal then closed up 12.9% on the 15th September.

Dunelm Group (DNLM) received a Buy signal on the 15th July on the back of news that sales had jumped 20% in June, while online sales jumped 105% in the 2nd quarter. This positive news drove an increased target price of 1,400p up from 1,200p, which it later hit on 24th August up 22.1% in just over a month.

In August we identified a Buy signal on William Hill (WMH) on the 6th by Deutsche Bank who raised their target price to 160p, 26.5% above the then start price of 126.25p. The share price then jumped on news of stronger than expected performance and a cut to their debt. The signal then closed up 26.8% two weeks later on the 20th. Then again on the 16th September we identified a subsequent Buy Signal on William Hill (WMH) with a predicted 23% upside on the target price. Following news of takeover proposals shares soared over 36%, with the signal closing up 27% in just over a week.

Also that day (6th August) a Buy signal on Ocado Group (OCDO) was identified as a Trading Signal, with a Peel Hunt increasing their target price to 2,490p, 13.6% above the start price of 2,192p. This occurred as new estimates predicted they could take up to 25% of the online grocery market. Strong performance meant that the signal closed up 13.5% on the 24th.

The table below highlights the returns, from the above Stockomendation Trading Signals.

| Name of Stock | Date | Position | Performance |

|---|---|---|---|

| William Hill | 16th September | Buy | 27.0% |

| William Hill | 6th August | Buy | 26.8% |

| Dunelm Group | 15th July | Buy | 22.1% |

| Ocado Group | 6th August | Buy | 13.5% |

| Persimmon | 8th July | Buy | 13.0% |

| Avon Rubber | 13th July | Buy | 12.9% |

To view these and other historic Trading Signals click to visit our Trading Signals page.

Third Quarter Performances

Whilst the market has been extremely nervous about Covid and the economic recovery, it has fallen by 3.8% our Trading Signal service yet again has significantly outperformed the market this quarter by 7.2% finding the strongest signals from the UK’s top Tipsters and Brokers.

The Trading Signals service is proven to consistently outperform the market.

To find out more about our Trading Signals Service and find the latest generic UK stock tips visit us at www.stockomendation.com.

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 25th September 2020.