Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

This Week: Tipsters Positive on Dunelm Group, Downbeat on Debenhams

Debenhams (DEB) and Dunelm Group (DNLM) both featured heavily in the financial press this week and while both had some disappointing news to share, both broker and tipster outlook about the future of both companies was vastly different. This week, we take a look at the respective performances of each, and how tipster sentiment has shifted over time.

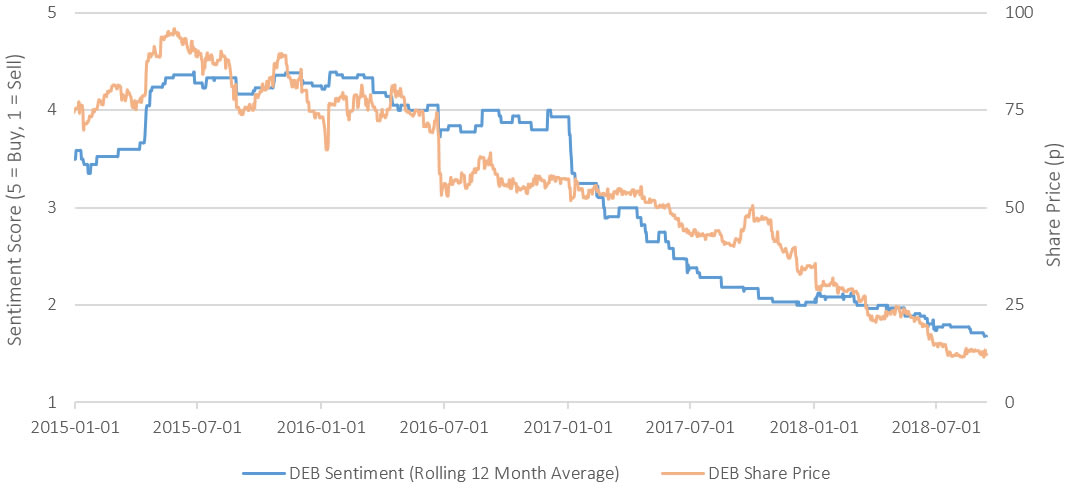

Debenhams has been far from a favourite amongst tipsters for some time now, with Motley Fool contributor Edward Sheldon recommending readers to “steer well clear”. Consensus sentiment towards the company dropped deep into “sell” territory in early 2017, and has since slid even further; firstly as short interest peaked at the beginning of the year, and secondly as the retailer issued three consecutive profit warnings. This week has seen more of the same, with reiterated “Sell” ratings from both Liberum Capital and Peel Hunt on Monday and Tuesday, respectively. Reports on Monday that it had brought in KPMG for a “last throw of the dice” restructuring sparked a 10% drop in its shares the day, and this was quickly followed by an RNS announcement from the company stating that it was “well equipped to navigate market conditions”. This announcement was met with further criticism however, with ShareProphets’ author Tom Winnifrith considering the announcement to constitute a profit warning. The share price bounced back briefly on Tuesday and Wednesday, before sliding again at the end of the week. Tipster sentiment stands at its lowest level since Stockomendation started tracking stock tips on the company in 2013.

Share Price & Tipster Sentiment: DEB

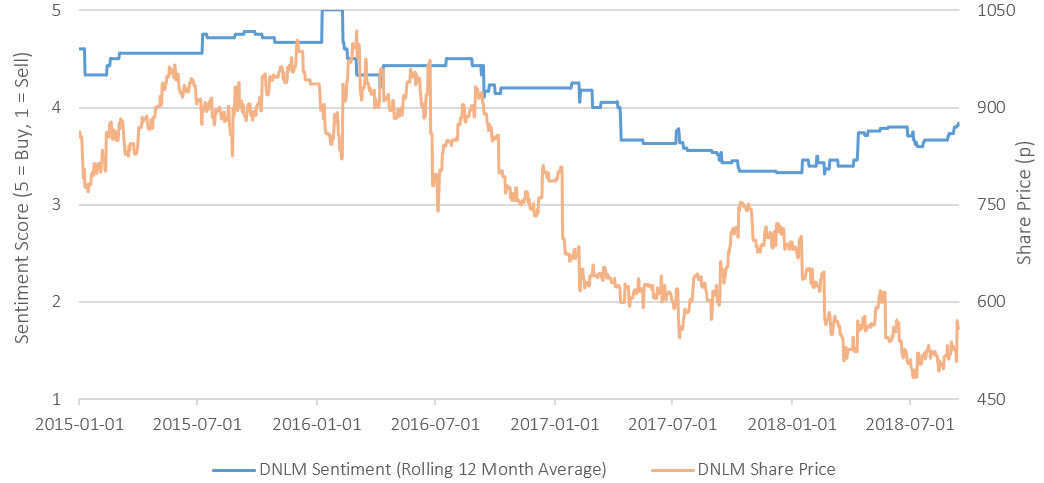

High street turbulence also contributed to a “difficult and disappointing year” for Dunelm Group, as underlying profits fell for the second year in a row. Shares in the retailer had slumped 24% between the beginning of the year and last Friday (7th). However, there was some respite for shareholders with shares up 7% this week, and increased optimism amongst tipsters and brokers in recent weeks. Although sentiment dropped considerably in 2016 and 2017, this year has seen increased optimism, and sentiment remains between “Hold” and “Buy” territory.

Tipsters such as Rupert Hargreaves, Peter Stephens and Robert Stephens have recently considered the company as a “Buy”. Earlier this week, Roland Head of the Motley Fool considered the 2019 forecast P/E of 12, and the yield of 5.3% to be “too cheap…I’d rate this stock as a buy”, while for Chris Bailey “the scope for the share price to squeeze to six quid and more for me is clear”. Paul Summers offers a contrarian view, opting to “sit on the sidelines” after “taking into account its rising debt levels and fragile consumer confidence”. Current consensus sentiment towards the retailer is at its highest since early 2017.

Share Price & Tipster Sentiment: DNLM

You can track up-to-date tipster and broker sentiment at Stockomendation. Our current platform allows you to performance-track over 40,000 stock tips from over 330 tipsters and brokers. Sign up now and take a look for yourself – it’s FREE!

Disclaimer: The contents of this article should not be considered financial advice. Data accurate as of 13th September 2018.