Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Unilever (ULVR) by Deutsche Bank

- Buy Experian (EXPN) by Goldman Sachs

- Neutral GSK (GSK) by Citi

- Overweight Auction Technology Group (ATG) by JP Morgan

- Buy Ibstock (IBST) by Jefferies

- Buy Forterra (FORT) by Jefferies

- Buy Dunelm Group (DNLM) by Jefferies

- Hold Greggs (GRG) by Jefferies

- Add Diageo (DGE) by Stephen Wright in The Motley Fool

- Add LondonMetric Property (LMP) by Zaven Boyrazian in The Motley Fool

- Add Prudential (PRU) by Andrew Mackie in The Motley Fool

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Buy Vodafone Group (VOD) by LBBW

- Neutral Linde (0M2B) by JP Morgan

- Neutral Airtel Africa (AAF) by Citi

- Buy Linde (0M2B) by Citi

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

This Week’s Tip Activity: Barratt Developments, AO World and Mitie Group

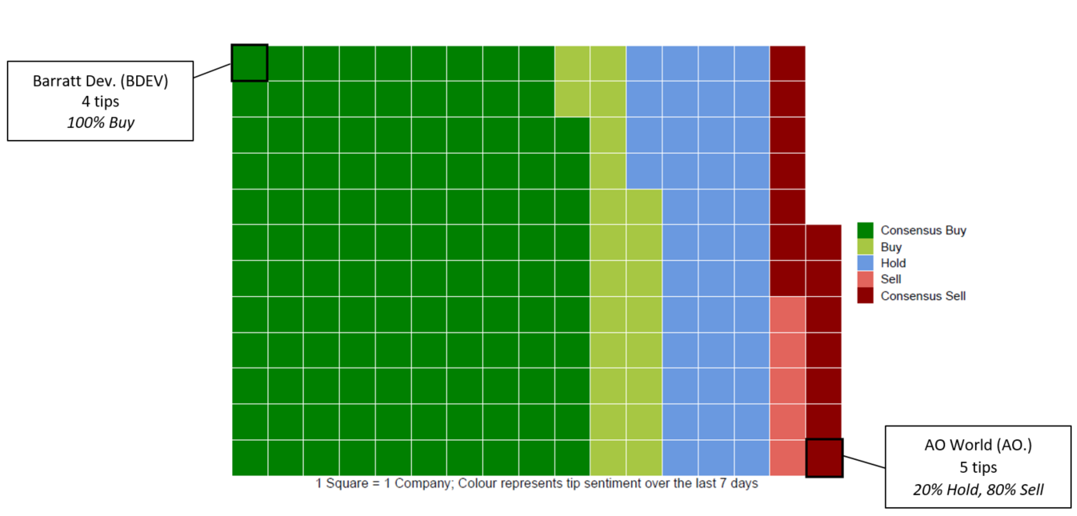

Just under 200 UK companies have been tipped by 16 brokers and 26 professional tipsters tracked by Stockomendation over the last seven days. Overall tip sentiment was positive for a majority of tipped companies (70%), and negative for a small minority (10%). In this week’s issue, we highlight the most frequently tipped company, as well as those firms with the highest consensus positive and negative ratings.

LSE Main Market & AIM Company Sentiment (16-22 September)

Most Frequently Tipped Company: Mitie Group (MTO)

Tip Sentiment: 83.3% Buy, 16.67% Hold, 0% Sell; Share Price -0.4% in last 7 days

Facilities management firm Mitie Group announced interim results on Thursday, in which it boasted “improving prospects for growth” and announced full-year expectations on line with guidance. Shares rose over 3.7% in the seven days prior to publication of the results as the company announced it was selling its Social Housing business to Mears Group (MER) for up to £30m, but that performance was wiped out by Thursday’s financials as it lost nearly 4%. Sentiment towards the firm remains high, with Liberum Capital reiterating a buy rating through the week, and Canaccord Genuinty also reiterating a positive rating.

Tipster Roland Head (The Motley Fool) struck a cautious yet positive tone and sees shares as a “turnaround buy with long-term potential”, but expresses concern about the firm’s debt levels. James Ashton (Telegraph Questor) also finds shares to be risky but ultimately “worth a punt”, adding that “the firm has had a torrid time but its costs are falling and margins are on the rise”. Elsewhere, Peel Hunt reiterated its neutral stance with a ‘hold’ recommendation this week.

Highest Proportion of Buy Ratings: Barratt Developments (BDEV)

Tip Sentiment: 100% Buy, 0% Hold, 0% Sell; Share Price +0.4% in last 7 days

Barratt Developments (BDEV) featured in our blog on the “Help to Buy” scheme back in early-September, and 82% of ratings placed on the UK housebuilder since have been ‘buy’ ratings. This week, Roland Head (The Motley Fool) is cautiously optimistic about the firm’s prospects, and adds that the shares “could be worth considering as an income buy”. Broker HSBC also issued a ‘buy’ rating on the shares last week. Royston Wild (The Motley Fool) considers Barratt to be a “rock-solid, big-yielding share” and is convinced that the company can “continue generating solid profits growth”. However, the tipster notes that “they’re not immune to any Brexit-related shocks”. With regards to the industry outlook, ShareProphets author Tom Winnifrith this week issued a stark warning that “there really could be a big fall in UK house prices and volumes, and it is just partly linked to Brexit”.

Highest Proportion of Sell Ratings: AO World (AO.)

Tip Sentiment: 0% Buy, 20% Hold, 80% Sell; Share Price -2.1% in last 7 days

Shares in AO World sank on Tuesday after it announced an underlying loss of £5.4m in its interim statement, before rallying on Wednesday and dropping again on Thursday, leaving shares down for the week. Broker Peel Hunt issued the only non-negative research note and reiterated its hold rating. Elsewhere, there were sell recommendations from brokers and tipsters. Shore Capital renewed its sell stance, while Steve Moore (ShareProphets) questions whether the “high growth company rating can really be justified”, and retains a sell rating. GA Chester (The Motley Fool) offers a similar opinion, querying whether its premium rating is merited, and adding that downgrades to analyst forecasts making “the existing 92 times forecast 2020 earnings even less attractive”. The tipster therefore “continues to see it as a stock to avoid”. The last ‘Buy’ tip for AO World came courtesy of broker Numis back in July.

There are now over 45,000 tips on our platform, all performance-tracked and available to view. Sign up to Stockomendation now and take a look for yourself – it’s free!

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 23rd November 2018.