Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Tipster Activity Around Earnings Announcments

With a number of annual reports due for high-profile FTSE 100 firms in the coming weeks, our analyst takes a look into the relationship between publication of annual reports and tip activity of professional analysts, commentators and bloggers.

Trawling through annual reports is becoming an increasingly time-consuming task for shareholders and potential investors each year, with research by Deloitte finding that annual reports grew in size again last year and now span an average 155 pages. For those lacking time in the day, or keen investors seeking wider consensus opinion, tipster and broker analysis can therefore provide a condensed, time-effective research tool.

One of the questions we often receive here at Stockomendation is whether tipsters and brokers just respond to company filings, or whether they’re monitoring the companies they tip all year round.

Taking a look at 2018 so far, 329 UK-listed companies tipped by brokers and tipsters have released final annual statements for the most recent financial year. These companies have attracted 2,472 tips; 67% of tips were placed before the company released its earnings, compared to 31% placed afterwards. This is perhaps no surprise, given that we’re looking at the first five months of the year, and few companies publish in January/February. More interesting, though, is that 13% of tips are made within a period spanning the five days before and after publication of a company’s annual report.

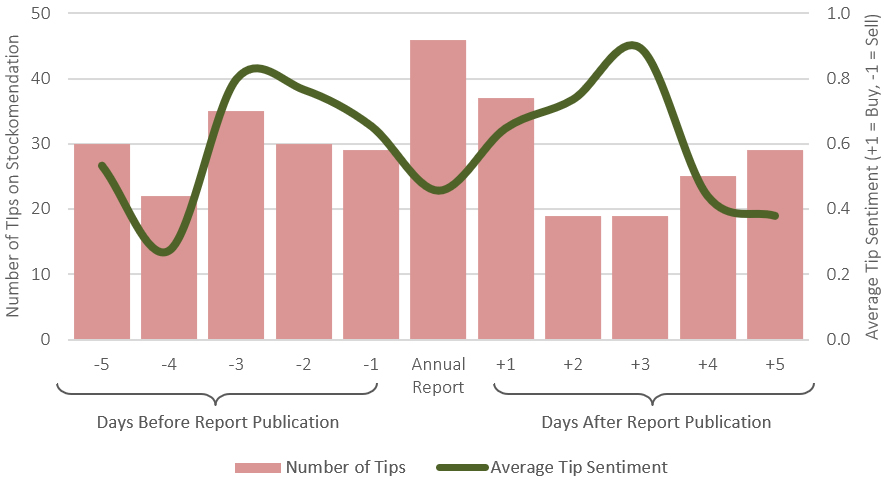

Tipster Activity Increases, Sentiment Decreases on Publication of 2018 Annual Report (So Far....)

Note: Sentiment is measured as the average of tip sentiment where 'Buy' and 'Risky Buy' tips are assigned a score of +1, 'Hold' tips are assigned a score of 0, and 'Sell' and 'Avoid' tips are assigned a score of -1. Based on 2,473 tips placed on 329 companies between 1st January and 30th April 2018.

Clearly, the release of annual reports plays some role in the type of companies that tipsters and brokers focus on*. Not ground-breaking news in itself, but more interestingly (as the figure above shows) there is more tip activity prior to annual report publication, compared to afterwards. There is also a clear increase in the number of tips and recommendations on the day of publication, and the day afterwards. Tip activity then dies down, presumably as tipsters and brokers switch focus to the next reporting company.

The chart also shows that tipster and broker sentiment is highest in the periods just above, and after publication, as tipsters and brokers attempt to pre-empt and dissect the key takeaways from the company’s performance figures. Interestingly, sentiment is also noticeably lower on publication date. Accessing a company’s tips on publication date can therefore provide a wider variety of viewpoints; you can access the bull and the bear cases for each company and thus make a more informed decision.

So, what does this mean for our users of Stockomendation?

- Firstly, you can stay ahead of the curve and see what the tipsters and brokers are saying before the annual report is available, potentially pre-empting any nasty (or nice) surprises on publication date.

- Secondly, you can check consensus opinion amongst the Stockomendation community on the day of annual report publication, and access tipster/broker research notes, to condense all the analyst commentary into our intuitive, time-effective research platform.

- Thirdly, you can offer your thoughts to expand our community opinion. Do you agree or disagree with a particular tip? Use our interactive polling tool for each tip to let others know your own opinion.

You can do all this, for free, using the Stockomendation platform. With final results due for companies such as BT Group (BT.A) and Marks & Spencer Group (MKS) later in May, why not add these companies to your Stockomendation Watchlist and keep up-to-date on tipster and broker opinion as it comes in.

* Readers should be aware that there are other factors, such as interim filings and RNS announcements that could motivate tipster and broker activity.