Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

- Outperform International Consolidated Airlines Group SA (CDI) (IAG) by ODDO BHF

- Underperform Wizz Air Holdings (WIZZ) by ODDO BHF

A Tale of Two Retailers...

In this week’s blog, we take a look at the mixed fortunes of two large UK retailers heavily tipped by tipsters and brokers in recent days. For Ocado Group (OCDO) it was the best of times, as shares soared to all-time highs after announcing a partnership with US retail giant Kroger. Meanwhile, a glance at the annual figures for Marks and Spencer Group (MKS) – such as a 62% drop in after-tax profits – would have investors believing it to be the worst of times.

Ocado has now taken over M&S in terms of size by market capitalisation, and the relative success and failure of these business in recent years is particularly interesting given ex-M&S chairman Sir Stuart Rose joined Ocado as chairman in May 2013, when the share price was languishing at around 25% of its current value.

Broker and Tipster sentiment has shifted significantly towards the company; 86% of tips in 2014 recommended readers ‘Sell’ or ‘Avoid’ shares in Ocado, whereas that figure lies at just 22% in 2018 so far. The chart below illustrates how tipsters have been increasingly bullish about Ocado in the last two years, with the average rating moving into positive ‘Buy’ territory before the turn of the year. Though consensus opinion is informative, it can also be worth listening to the contrarians; Tipster Robert Stephen’s ‘Risky Buy’ rating in March 2017 has netted an impressive performance of 234% so far! Can the firm’s share price keep rising? Gary Newman doesn’t think so, claiming the company to be 'too expensive’ at these ‘crazy heights’.

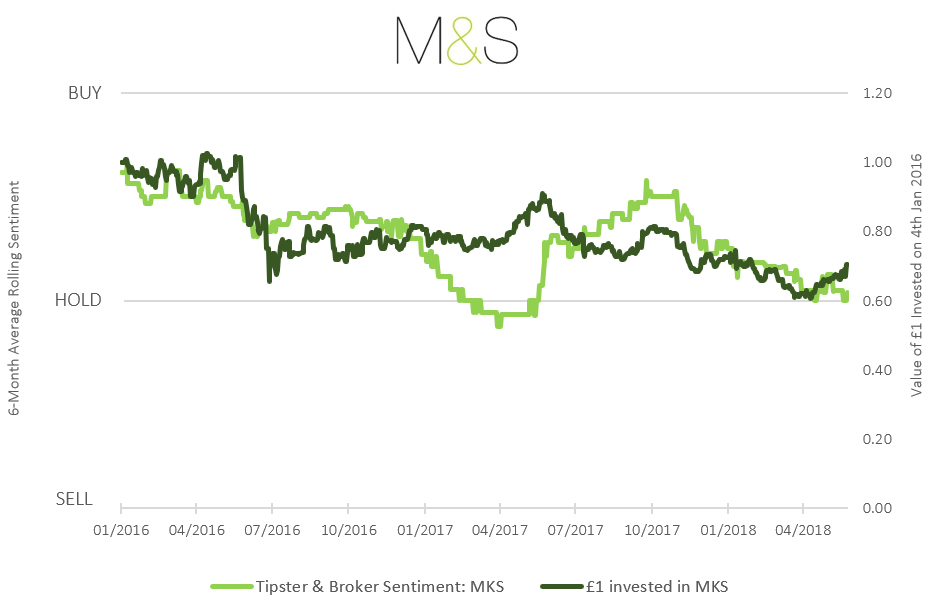

The chart below shows similar data over the same period for Marks and Spencer Group. It is clear that Broker and Tipster sentiment has been sliding in line with the companies share price since the beginning of 2016, although this correlation is not quite so strong as it was for Ocado- Broker and Tipster sentiment diverged from the general share price trend during 2017 before once again moving in line this year – and the current average sentiment lies precariously balanced at the neutral ‘hold’ level. That being said, the increasingly negative viewpoint is not shared by everyone with some tipsters believing the worst to be over; tipster Roland Head claimed M&S share price ‘could make it the best buy in the FTSE 100’ in the Motley Fool this week.

So, how can Stockomendation users identify these trends, and identify the contrarians that are worth following?

- Keep an eye on aggregate Broker and Tipster sentiment on the ‘Companies’ page on the website, which gives you an at-a-glance overview of all open tips.

- If you notice a tipster offering a contrarian rating, add them to your ‘Watchlist’ and be notified next time they tip, while you can also review their historical performance statistics in the ‘Tipsters’ page.

- Look out for some great upcoming features soon the be added the Stockomendation site; allowing you to identify tipsters that have demonstrated a proven track record in tipping a particular company or industry.

Here at Stockomendation, we’re performance-tracking over 34,000 stock tips and counting. Sign up now and take a look for yourself. Better yet – it’s FREE!

Disclaimer: The contents of this article should not be considered as financial advice. All information correct as at 24th May, 2018.