Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

What happens when Brokers and Tipsters disagree?

Here at Stockomendation, we offer a unique service by performance-tracking recommendations not just by brokers, but professional tipsters too. As a result, we’re regularly asked two questions; ‘do brokers and tipsters ever disagree?’. The answer: Not always, but when they do, it can be the more bullish of the two that wins out in the short term.

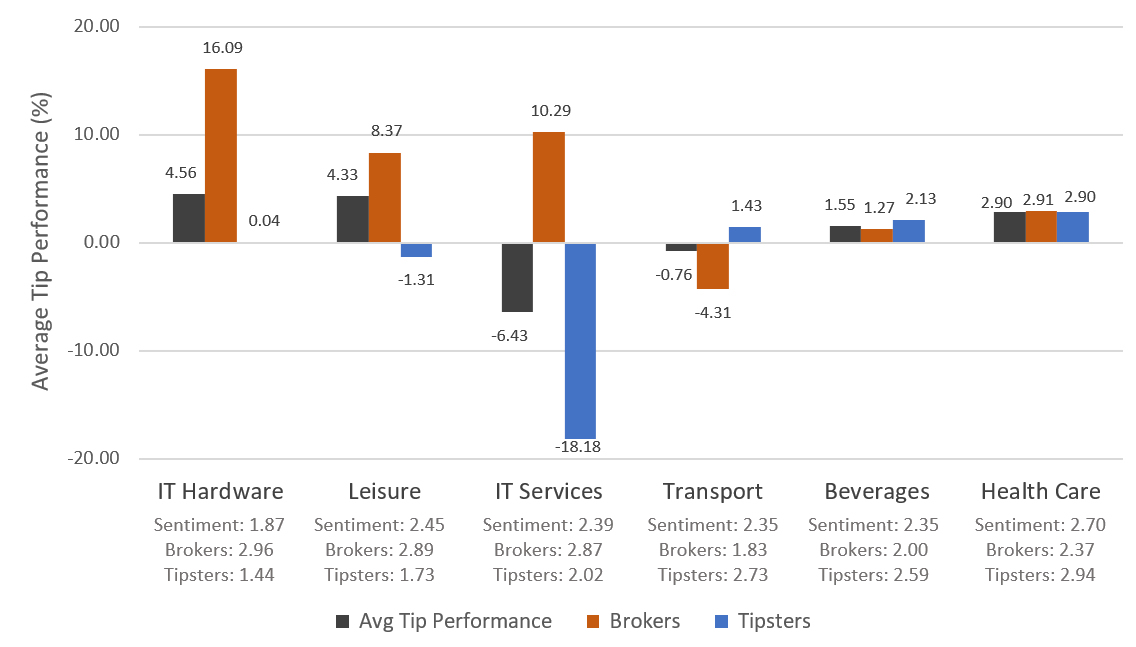

So far in 2018 brokers are currently outperforming tipsters in two-thirds of industry sectors. That’s based on nearly 6,000 tips made this year that we’re currently performance-tracking on the Stockomendation platform; over half of which have been made by brokers. By giving ‘Buy’ and ‘Risky Buy’ tips a score of 3, ‘Hold’ tips a score of 2 and ‘Sell’ and ‘Avoid’ tips a score of 1, we can calculate average sentiment score for each sector. By doing so, we find that tipsters and brokers share broadly the same outlook in 2018. The average score for tipsters is 2.53, compared to 2.59 for brokers. However, when in sectors where tipster sentiment is considerably higher than brokers, tipsters can outperform, and vice-versa – in some cases by as much as 28%!

The chart below shows average tip performance for sectors with the largest difference in ‘buy’ and ‘sell’ sentiment by brokers and tipsters. In the first three sectors, broker outlook is more positive than tipsters. In the last three, tipster sentiment is more positive. In nearly all cases, the more positive of brokers or tipsters achieves greater performance. In IT Services, for example, broker sentiment (2.87) is higher than tipster sentiment (2.02). While brokers have achieved an average 10.3% tip performance in the sector, tipsters have negative performance of -18.2%! In this case, a number of ‘sell’ tips on Tern PLC by tipsters which have backfired, causing such extreme performance in the sector.

Where Brokers and Tipsters have disagreed in 2018, the more bullish of the two tends to outperform (so far)...

Note: Data correct as at 14th May 2018. Sectors only valid for inclusion if they have a minimum of 10 tips in 2018 from both tipsters and brokers. Sectors are those used on the Stockomendation platform; 'Commercial Transport'ahown as 'Transport' and 'Leisure Products' shown as 'Leisure'.

This is ultimately what makes ‘sell’ recommendations such a bold call – the potential losses are limitless, and this can really affect average performance. Tipsters have however outperformed brokers by nearly 6% in the Commercial Transport sector; a sector in which tipster outlook (2.73) was much more positive than brokers (1.83).

What does that mean for investors, and more specifically, users of Stockomendation? When deciding which financial market research to take note of (perhaps by adding a broker or tipster to your Stockomendation ‘watchlist’), it should not be a case of picking “one or the other”. Instead, the key is in identifying the specific brokers or tipsters to follow in each sector, and their past performance when they issue ‘buy’ or ‘sell’ tips. Who has a proven track record in picking winners within a sector, and are they bullish, or bearish? Have their sell tips performed well in the past?

At Stockomendation, we offer the ability to see a broker or tipsters performance in each sector, along with their biggest winners and losers. You can also see current aggregated sentiment towards a company on the companies section of the Stockomendation platform. What’s more, Stockomendation will soon be unveiling some additional tools to highlight the brokers and tipsters you should be following in each sector. Watch this space!