Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Can "Sticking to Your Guns" Pay Off?

Social psychologist Leon Festinger noted that “a man with a conviction is a hard man to change”. The uncertain nature of financial markets, driven by the changing fortunes of public companies, is ultimately what makes them so fascinating. It also demands an ability to adapt one’s beliefs in light of new evidence, to ensure we don’t hold stocks for too long and eradicate our gains (or further our losses). Sometimes, however, a firm conviction in an idea – even when the market is going against you - can ultimately pay off in the long run.

Stockomendation has been tracking tipsters since 2013, and during this time we’ve seen a broker or tipster tip the same company as often as eighty times, and on nearly 500 occasions a tipster or broker has tipped the same company ten times or more. We took a look at these in detail to see whether consistently taking a positive (or negative) stance on a company paid off, or whether changing outlook led to greater performance.

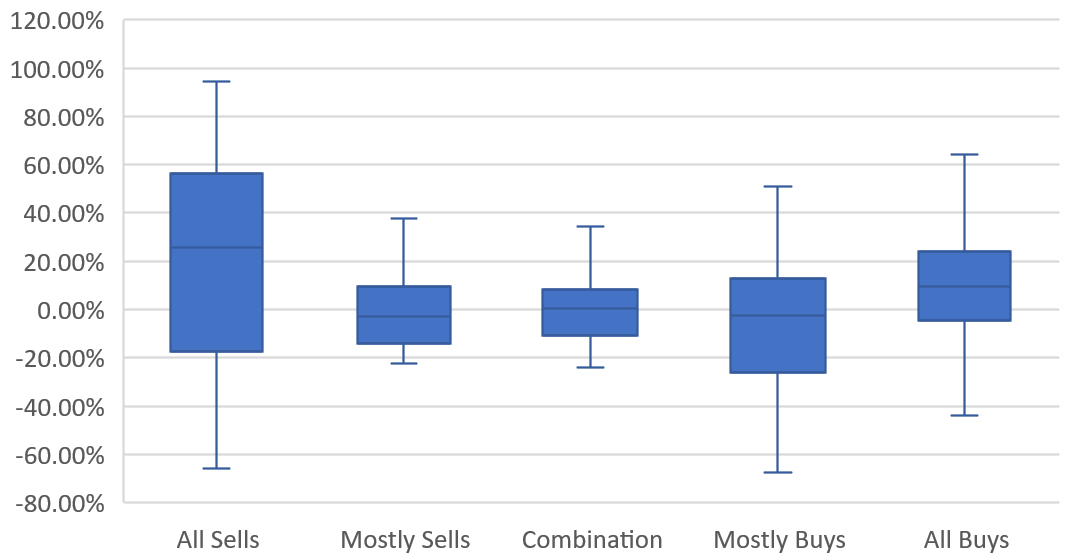

The chart below shows that tipsters/brokers who initially tip a company as a sell and “stick to their guns” typically produce greater performances on average (25.8%). However, there is also a very high level of variation in their performance, with negative performance recorded on nearly 40% of occasions. Not for the faint hearted! Likewise, tipsters and brokers who maintain a “buy” rating also perform well on average (9.7%), though again there is a large amount of variance in these performances and some have resulted in huge negative performances.

"Sticking to Your Guns" Can Lead to Greater Performance, But With More Risk...

In contrast, tipsters that change their opinion regularly and have a more even distribution of buys and sells have produced as much as 30% in some instances, but the average is a mere 0.5%. As can be see from the chart, however, there is much less variation in tip performances. Changing your opinion appears to ensure much more stability, but at the cost of potential greater performance.

So, what does this mean for users of Stockomendation?

- You can check the historical tips made by a tipster or broker about a company you are interested in; have they tipped the company before, and if so have they changed their opinion or has their view remained constant through time?

- You can observe a tipster or brokers entire tip history; do they have a record of consistently tipping the same companies? If so, what is their rate of success? Have they proven to be correct in the long run previously when doing so?

- Do you agree/disagree with reiteration of a tip, or has your own view changed? Let us know using our ‘Community Opinion’ feature.

You can gain access to all of the above data on the Stockomendation platform. Better yet – it’s FREE to our users.

*Note: The content of this article should not be considered financial advice.