Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

It's More Than Just A Game

With the FIFA World Cup just days away, this week we focus on how tipster and broker sentiment towards sports betting firms changes during major international football tournaments. Be it online or on the high-street, gambling firms will be set for an influx of sports betting activity in the coming days as the public place their bets on the outcome of the upcoming World Cup. The UK public wagered a predicted £500m during the last European Championships in 2016. So, how does tipster and broker outlook change during major tournaments, and more specifically, does the performance of the home nations affect both sentiment and sector returns?

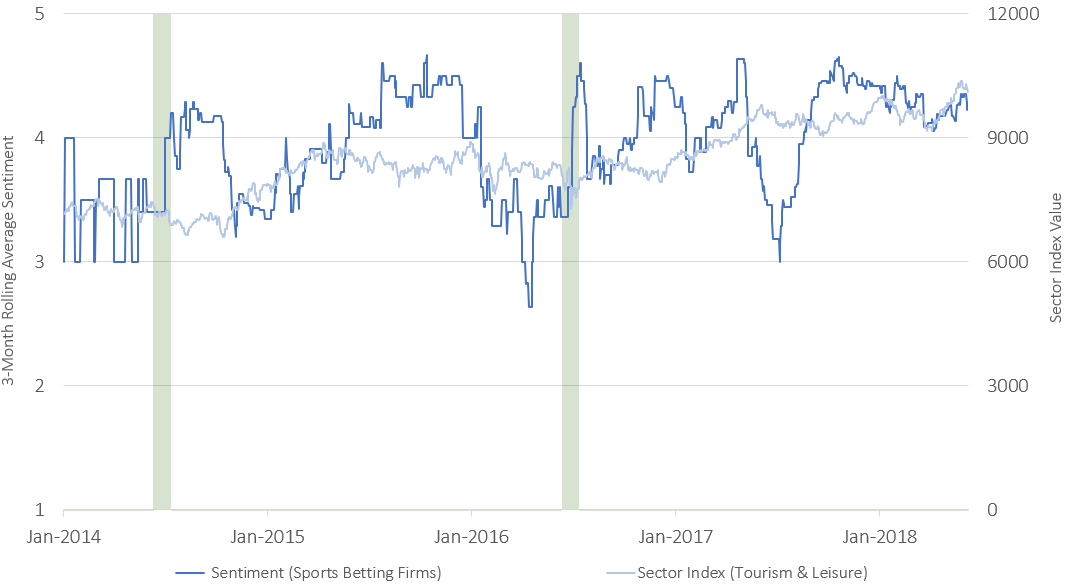

The chart below shows the average sentiment of brokers and tipsters, since 2014, towards gambling firms listed on the London Stock Exchange. A score of 5 indicates a consensus ‘Buy’ and 1 a consensus ‘Sell’. The value of the ‘Tourism and Leisure’ sector, within which gambling firms are typically placed, is also shown. The highlighted periods represent the date ranges of the 2014 World Cup, and the 2016 European Championships.

Broker & Tipster Sentiment Increased During WC 2014 & Euro 2016...

On both occasions, sentiment towards betting firms increased during the tournaments, while the sector index lost value over the same period – suggesting that brokers and tipsters were more bullish towards the industry as the tournament took place, while the wider markets were more bearish. It is no surprise that the presence and the success of home nations would impact the fortunes of betting firms; with a hefty proportion of bets typically placed on competing home nations, an optimal outcome for bookies would be for England to reaches the later stages of the upcoming tournament – but not win! To quote a William Hill spokesperson; “the England team deserve to be knighted for their services to the betting industry”.

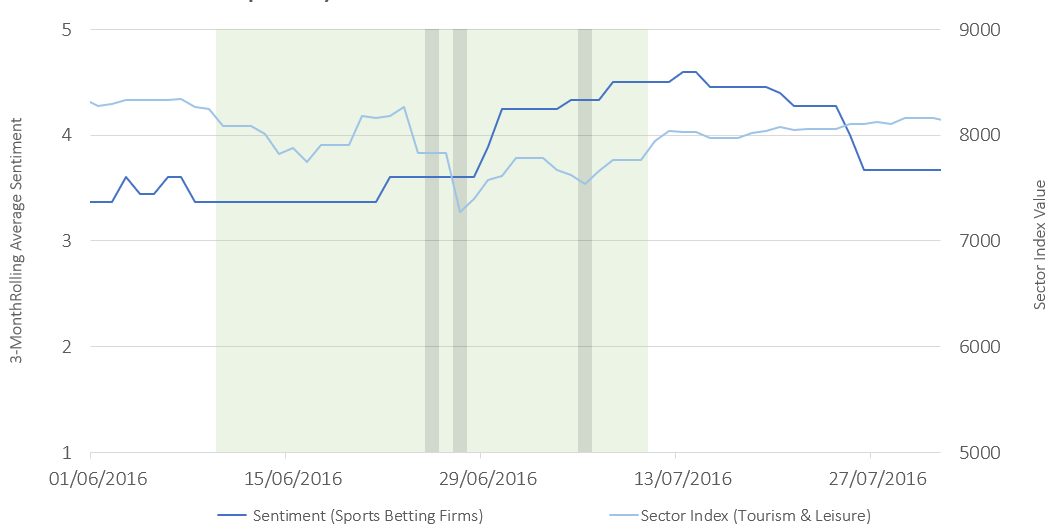

This is reflected in the chart below, which shows a snapshot of sentiment during the last European Championships in 2016. The dark columns indicate days on which a home nation was eliminated (Northern Ireland, England and finally Wales). Following the dismissal of home nations teams, broker and tipster sentiment increased, which perhaps can be credited to a relief that a major pay out by betting firms is no longer on the cards. In contrast, the sector index value decreased with investors discounting the ‘feel-good’ factor impact on the economy following World Cup triumph. This, in turn, potentially leads to undervalued stocks – which could be another reason why investor sentiment reacts so positively to seemingly bad news! Over the longer term, the sector has shown to recover – positive sector performance followed in the twelve months following both the 2014 and 2016 tournaments. Perhaps then, the tendency for the England team to flop at major events might not be so bad; for the shrewd investor at least, not the football romantics amongst us.

...especially after the home nations were eliminated!

As a Stockomendation user, you can keep ahead of the curve with all the latest trends:

- Monitor our snapshot of open tip sentiment within all sectors, including Tourism and Leisure.

- Add companies in this sector to your ‘Watchlist’, and receive our Stock Tip Alerts whenever a new tip is made.

- See which other sectors are trending over the last few days using your ‘Dashboard’, and conduct your own analysis.

Here at Stockomendation, we’re performance-tracking over 34,000 stock tips and counting. Sign up now and take a look for yourself. Better yet – it’s FREE!

Disclaimer: The contents of this article should not be considered financial advice. All information correct as at 7th June 2018