Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

How Do Tipsters React To Share Consolidations?

Share consolidations – a process in which a company’s existing shares are combined into a proportionally smaller number of new shares – shouldn’t impact on the value of a firm. If a company trading has 10,000 shares in issue trading at £1 per share, after a 1-for-10 consolidation it would have 1,000 shares issued worth £10 each. The value of the company is still £10,000. That being said, consolidations can often be perceived by investors as a sign of weakness and so the announcement of this type of corporate action may affect an investors outlook on the future of the company.

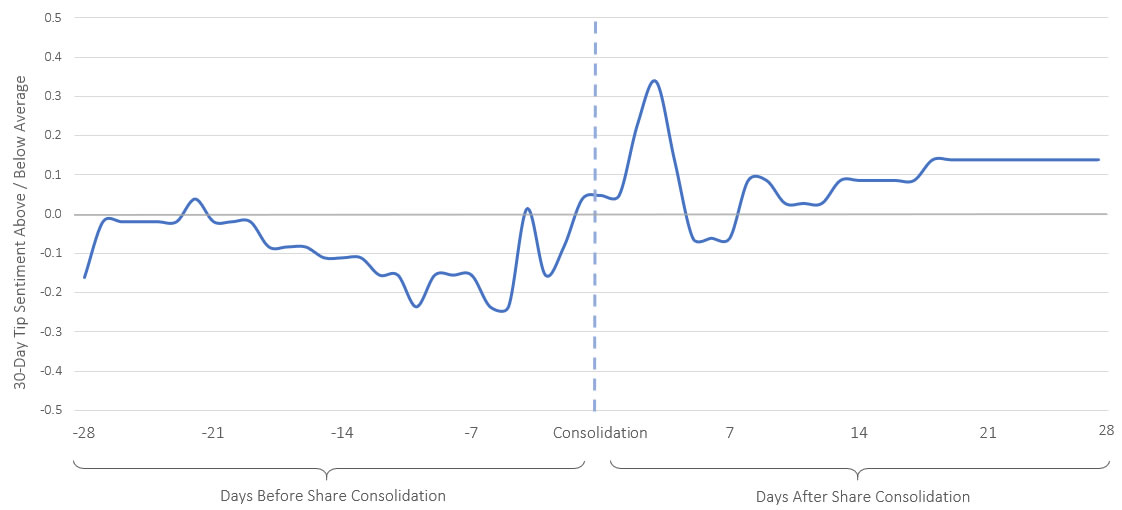

Looking in more detail at this, we took a look at a sample of share consolidations that took place for London Stock Exchange-listed firms since early 2016, and measured average tipster and broker sentiment in the four weeks before and after the effective date of the consolidation. Although by this time investors will in most cases be informed of the company’s intention to consolidate its shares – which may have impacted both sentiment and share price – we also noticed some interesting activity in the days around the consolidation date itself, which is reflected in the chart below:

Tip Sentiment Is Lower Before Share Consolidations & Higher Afterwards

Notes: 'Tip sentiment' is measured as a 30-day rolling average where 'Buy' and 'Risky Buy' tips are assigned a score of +5, 'Hold' tips are assigned a score of 3, and 'Sell' and 'Avoid' tips are assigned a score of 1. Comparison is versus average daily tip sentiment for the companies concerned. Based on a sample of 61 stock consolidations for firms listed on London Stock Exchange within the last two years. Date compiled: 14th June 2018

This chart shows the level of broker and tipster sentiment around share consolidations, compared to the average level. There is a higher proportion of buy ratings than average when the line is above zero, and an increase in sell ratings when below zero. It is apparent that, on most days leading up to the consolidation, tipster sentiment is lower than the average level. This could be a lingering effect of the negative outlook that the initial share consolidation announcement generated. Given that consolidations can be seen as bad news, this is no real surprise.

However, on the day that the consolidation takes place, and for most of the four weeks following, tipster sentiment increases above the average level for the period – especially in the immediate aftermath. This could be, to some extent, because tipsters and brokers consider the worst to be over, and for the consolidation to be considered a ‘fresh start’. Also, considering that share prices tend to increase upon split announcements, and decrease upon consolidation announcements – perhaps the shares are seen at this point to be ‘cheap’ and worthy of a ‘buy’ rating? It is difficult to say – the reasons may be different in each case – but with Stockomendation you can see what the tipsters and brokers justification is by viewing the source article of the tip (where available).

This article also highlights the importance of keeping track of company announcements. With Stockomendation, you can follow our RNS (Regulatory News Service) feed and receive notifications when a company on your ‘Watchlist’ next makes an announcement. Alongside the 36,000 performance-tracked tips on our site, these are just a couple of additional research tools available on the Stockomendation platform. Better yet – you can access them for FREE here!

Disclaimer: The contents of this article should not be considered financial advice