Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

A Month in Review: May 2018

It was another busy month for brokers and tipsters in May, with over 1,300 new tips captured and performance-tracked by Stockomendation, an increase of 47% on the same period last year. It was also a much busier month for brokers than tipsters; nearly 68% of new tips tracked on Stockomendation in May were made from brokers, which is the highest proportion of broker tips for any month in our history of tracking stock recommendations.

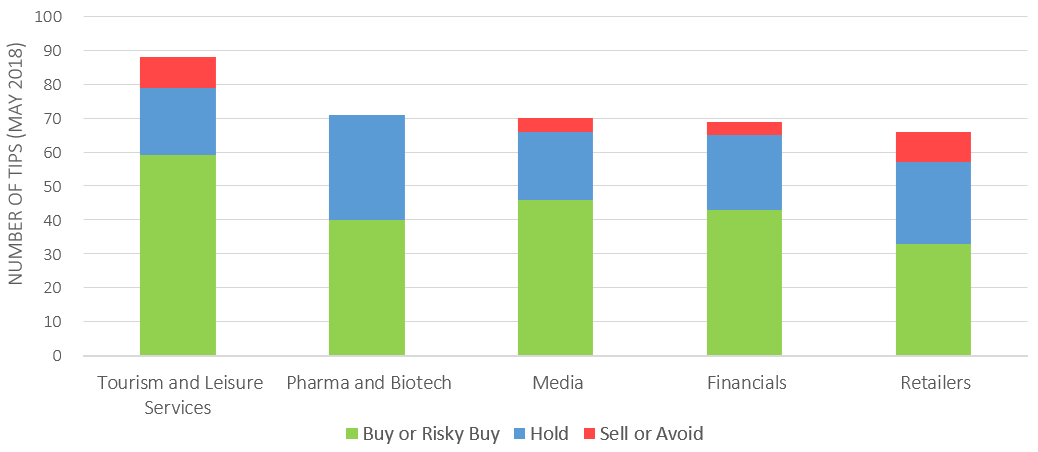

It was also a month that saw broker focus shift from a heavy focus on Retailers in April, to a wider variety of sectors. The chart below shows that Tourism and Leisure attracted the highest number of ratings, with broker sentiment marginally down in the sector (‘Buy’ and ‘Risky Buy’ ratings accounted for 67% of all tips in the sector, compared to 69% in April). Companies in the Pharma and Biotech sector also featured heavily this month, with the number of buy tips (56%) down from 65% in April. This seems to highlight a trend for the month, with an overall increase in the number of Hold recommends in May (248) compared to April (198). Increased focus in the Media sector paid off for brokers last month; the average tip returned 3.0% in this sector!

Tourism, Leisure & Pharma attracted Broker focus in May...

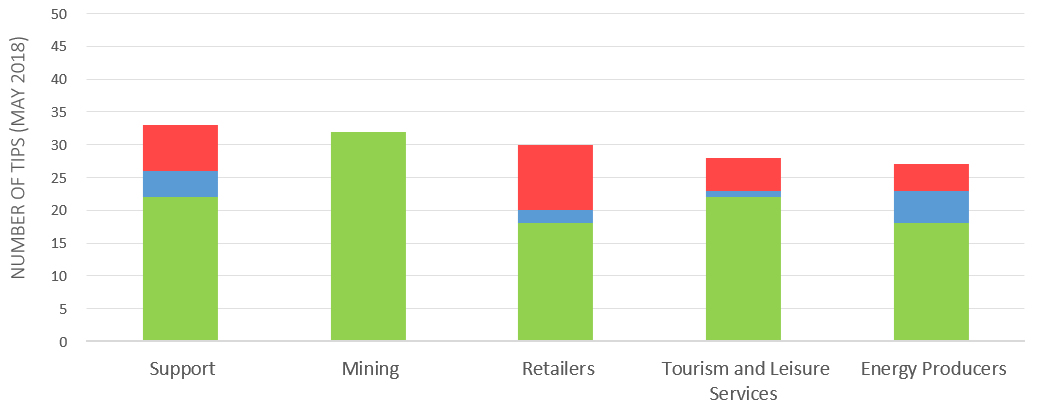

...while Tipsters were most active in Support and Mining

Whereas tipsters were also more focussed on Retailers in April, they were more concerned with Support firms in May; 33 tips were recorded in the sector, although this is down on the 46 tips placed last month. Tipster recommendations in the sector netted average performance of 0.6%. Again, whereas April saw tipsters more focussed on a few key sectors, tips in May were much more widely dispersed. Mining companies proved popular again amongst tipster last month, with sentiment in the sector at an all time high, while Retailers once again proved divisive with a number of sell tips placed for companies such as Marks and Spencer (MKS), Halfords Group (HFD) and Pets at Home Group (PETS). Tipster recommendations in the Alternative Investments sector did particularly well, with an average tip performance of 8.9% – primarily driven by Nigel Somerville’s tip to Sell AIQ Ltd.

So, how can Stockomendation users identify trends over the coming month?

- Monitor your Dashboard to see the most tipped sectors and companies each week.

- Keep an eye on aggregate Broker and Tipster sentiment on the ‘Companies’ page on the website, which gives you an at-a-glance overview of all open tips.

- Check out the ‘Sectors’ page on the Stockomendation platform to check broker and tipster sentiment of all open tips, and view details for each tip – including links to the tipster/broker notes.

Here at Stockomendation, we’re performance-tracking over 34,000 stock tips and counting. Sign up now and take a look for yourself. Better yet – it’s FREE!

Disclaimer: The contents of this article should not be considered financial advice. All information correct as at 1st June 2018.