Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Contrasting Fortunes for ASOS and Debenhams

Back in May, we looked at the contrasting fortunes of Marks & Spencer and Ocado. In a similar vein, we take a look this week at two companies in the UK retail sector that have made headlines in recent days – Debenhams and ASOS – and analyse how broker and tipster outlook has changed towards these companies in recent years.

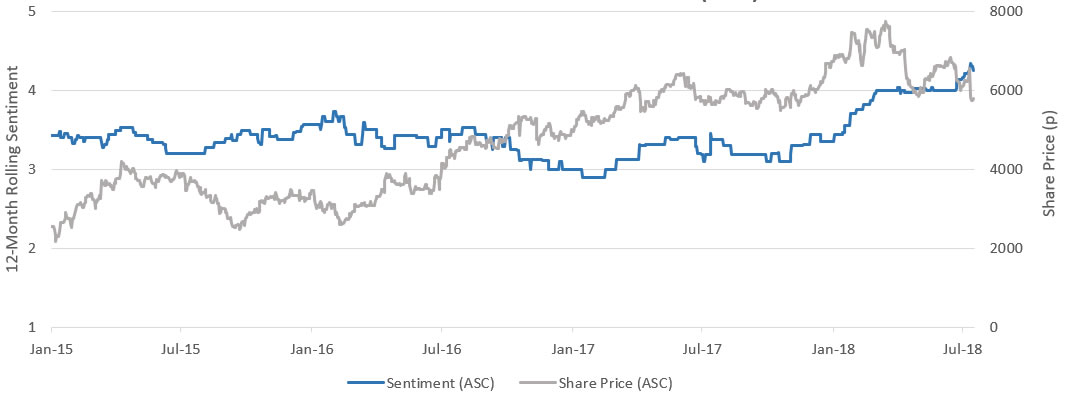

ASOS (ASC) have continually retained their status as the largest listing (by market capitalisation) on AIM. Although the current share price is some way off its all-time high of 7,730p – achieved in March this year - purchasing shares in the retailer back at the start of 2015 would have resulted in a price return of over 136% to date. The company has been subject to an influx of broker and tipster activity this month, especially after the group announced double-digit sales growth, but warned that full-year growth would be a little short of market forecasts in its latest trading statement. The average tip sentiment of brokers and tipsters is plotted below (where a ‘Buy’ rating is represented by a score of 5, ‘Hold’ by a score of 3 and ‘Sell’ by a score of 1).

SHARE PRICE & SENTIMENT: ASOS (ASC)

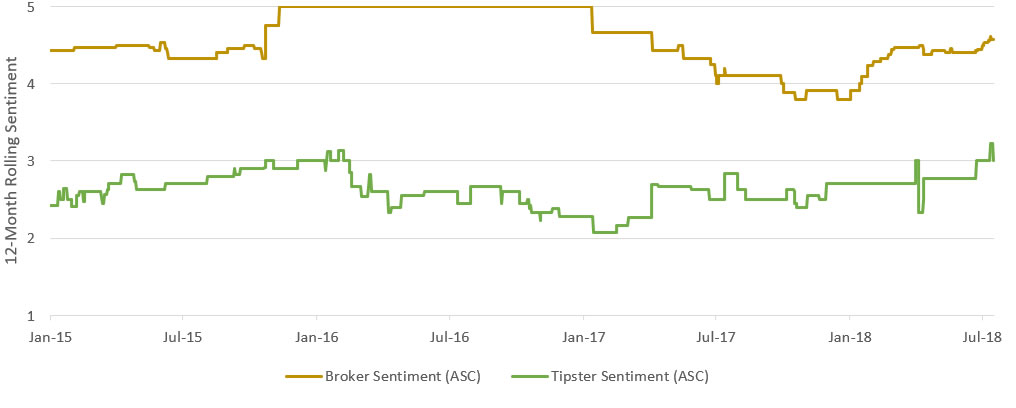

BROKER AND TIPSTER SENTIMENT: ASOS (ASC)

From charting the average tip sentiment for ASOS, it is clear that tipster and broker sentiment towards the retailer is at its highest level since the start of 2015. A current score above 4 suggests that a majority of brokers and tipsters consider ASOS to still offer a good buying opportunity, despite some recent turbulence in the firm’s share price. However, some remain sceptical; for example, Malcolm Stacey of ShareProphets considers the “ship to have sailed”, noting that “to buy more shares now might not be a good idea”.

Tipsters have generally been less bullish about ASOS’ prospects. Whereas the average broker tip has scored consistently above a 3 (representing a ‘Hold’ opinion’), tipster sentiment had – until recently – been below this level; a majority of tipsters have therefore been bearish about the company’s long-term prospects. That being said, the number of tips that ASOS typically receives from tipsters is far below the typical number of broker ratings.

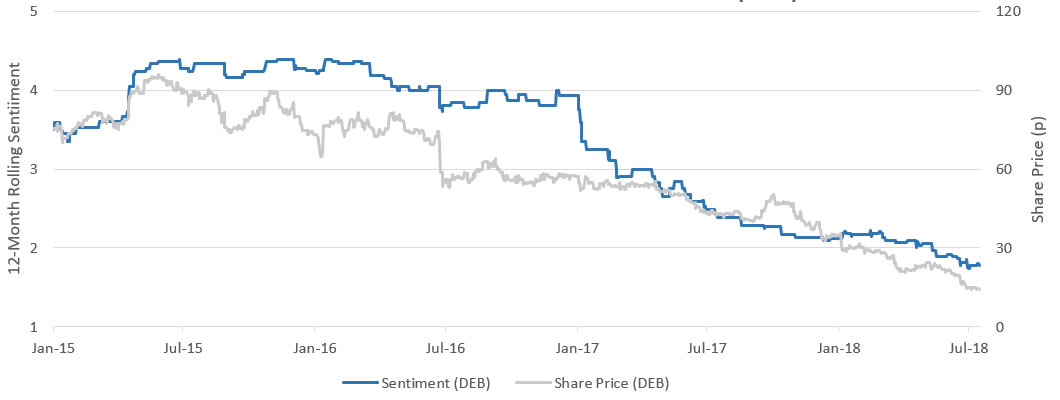

SHARE PRICE & SENTIMENT: DEBENHAMS (DEB)

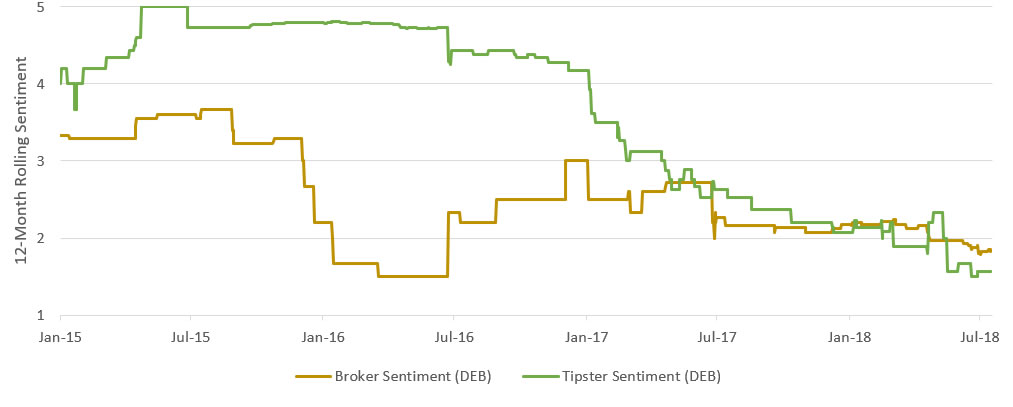

BROKER AND TIPSTER SENTIMENT: DEBENHAMS (DEB)

Recent history has been less kind to Debenhams; the company was forced to deny a cash flow crisis earlier this week after two credit insurers refused to cover some new suppliers to the retailer. The share price fell 7% as a result, and buying shares in the company back at the start of 2015 would have resulted in a price return of -83.51% to date. As a result, the chart displayed above shows average broker and tipster sentiment this month at its lowest level since the beginning of 2015; a score under 2 suggests that a majority of brokers and tipsters consider the company to be a ‘sell’.

Broker and tipster sentiment has moved approximately in line with the share price over this period, although it is interesting to note that broker and tipster sentiment diverged in 2016 and 2017; whereas brokers offered a negative outlook about Debenhams long-term prospects, tipsters were more bullish. The two have moved in line since the middle of last year – both in agreement that the retailers prospects aren’t good – and earlier this year tipster sentiment became more negative than brokers. The firm hasn’t received a positive rating from either tipsters or brokers since April this year.

Stockomendation users are able to see the consensus broker and tipster opinion of all open tips tracked on our platform, for every company listed on the LSE Main Market and AIM. You can also check out which companies and sectors are trending over the last seven days using our Dashboard feature, and view the original tipster research (where available). Our platform allows you to performance-track over 38,000 stock tips. Sign up now and take a look for yourself – it’s FREE!

Disclaimer: The contents of this article should not be considered financial advice. All information correct as at 18th July 2018.