Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Avoid Altitude Group (ALT) by Steve Moore in ShareProphets

- Buy Thor Explorations Ltd (DI) (THX) by Hot Stock Rockets in ShareProphets

- Watch Sanderson Design Group (SDG) by Steve Moore in ShareProphets

- Avoid Aptitude Software Group (APTD) by Steve Moore in ShareProphets

- Neutral BP (BP.) by UBS

- Neutral Drax Group (DRX) by Citi

- Buy RS Group (RS1) by Deutsche Bank

- Avoid Lloyds Banking Group (LLOY) by Royston Wild in The Motley Fool

- Buy easyJet (EZJ) by Citi

- Buy BP (BP.) by Goldman Sachs

- Overweight Fevertree Drinks (FEVR) by Barclays

- Neutral Barclays (BARC) by Citi

- Overweight Dunelm Group (DNLM) by JP Morgan

- Neutral Mondi (MNDI) by JP Morgan

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Antofagasta (ANTO) by JP Morgan

- Neutral Anglo American (AAL) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Buy Legal & General Group (LGEN) by Patrick Hosking in The Times - Tempus

- Neutral Senior (SNR) by JP Morgan

Trading Update Review: EasyJet, GVC Holdings and Just Eat

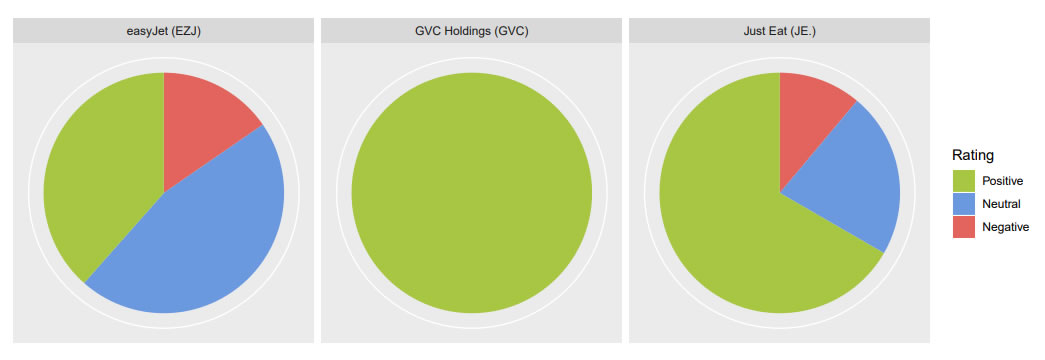

EasyJet (EZJ), GVC Holdings (GVC) and Just Eat (JE.) all released eagerly-anticipated trading updates within the last week, so it’s no surprise that they’ve been attracting the most attention from brokers and tipsters amongst LSE-listed companies over the last seven days. In this week’s article, we take a look at how brokers and tipsters have interpreted the most recent numbers, and what sentiment towards these three firms has looked like over the last seven days.

Tip Sentiment in 2019: EasyJet, GVC Holdings and Just Eat

Holders of easyJet’s (EZJ) suffered a nightmarish second half of 2018, but the airline’s trading update this week was broadly seen as positive, with “underlying progress in line with expectations”, an increase in underlying revenue per seat, and no apparent nasty surprises other than a one-off cost of £15m due to the drone disruption at Gatwick last month. That being said, broker Berenberg maintained a sell rating on the shares while lifting its target price marginally from £10.10 to £10.40. On the whole though, sentiment was largely positive or neutral. Brokers including JP Morgan, UBS, Morgan Stanley and Liberum reiterated neutral stances, while RBC Capital were more optimistic, placing a target price of £16.00 and an ‘outperform’ rating on the shares.

Tipsters are also bullish, with Joe Neighbour (SignalCentre), Peter Stephens (The Motley Fool) and Rupert Hargreaves (The Motley Fool) all tipping EasyJet shares prior to the most recent trading updated; those three shares have all produced positive performance of between +6% and +15% so far. Most recently, Roland Head (The Motley Fool) finds easyJet “isn’t without risk. But in my view, this airline remains one of the top picks in the sector”, while highlighting the firm’s “tempting” forward P/E ratio of 10.7 and 4.6% yield.

There was no disagreement when it came to GVC Holdings (GVC); brokers and tipsters were in agreement that the betting firm’s prospects looked good. Following a full-year trading update in which GVC announced earnings “ahead of market consensus”. Berenberg, Shore Capital and Peel Hunt have all reiterated buy ratings since the announcement with target prices of £11.00, £12.00 and £9.00 respectively. Shares were trading at £6.59 earlier today. Tipster G A Chester (The Motley Fool) notes that the company is one of the FTSE 100’s top performers over the last ten years and sees potential for growth in future, with an “undemanding P/E of 11.1 and a delicious 5% dividend yield”. Chris Bailey (ShareProphets) concurs, and reiterates a buy rating, adding that “progress looks good, unsurprisingly led by its online operations which showed a 15% advance”.

Finally, broker notes for Just Eat (JE.) came flooding in following its trading update this week, with a majority of brokers optimistic despite increasing competition from similar brands such as UberEats. The online food ordering service simultaneously announced Chief Executive Peter Plumb is to step down. Brokers JP Morgan, UBS, Barclays and Liberum all reiterated positive ratings, with target prices ranging between £7.85 and £12.50. Earlier today, shares were trading at £7.05. Canaccord Genuity downgraded the shares to a hold stance, while Peel Hunt offered the only sell rating with an accompanying target price of £5.20.

There are now over 45,000 tips on our platform, all performance-tracked and available to view. Sign up to Stockomendation now and take a look for yourself – it’s free!

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 24th January 2019.