Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Neutral Drax Group (DRX) by Citi

- Buy RS Group (RS1) by Deutsche Bank

- Avoid Lloyds Banking Group (LLOY) by Royston Wild in The Motley Fool

- Buy easyJet (EZJ) by Citi

- Buy BP (BP.) by Goldman Sachs

- Overweight Fevertree Drinks (FEVR) by Barclays

- Neutral Barclays (BARC) by Citi

- Overweight Dunelm Group (DNLM) by JP Morgan

- Neutral Mondi (MNDI) by JP Morgan

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Antofagasta (ANTO) by JP Morgan

- Neutral Anglo American (AAL) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Buy Legal & General Group (LGEN) by Patrick Hosking in The Times - Tempus

- Neutral Senior (SNR) by JP Morgan

- Avoid YouGov (YOU) by Steve Moore in ShareProphets

- Buy BP (BP.) by DZ Bank

- Avoid Warpaint London (W7L) by Steve Moore in ShareProphets

- Buy Vodafone Group (VOD) by DZ Bank

- Watch Mony Group (MONY) by Simon Watkins in The Motley Fool

Trading Updates: Pearson and J D Wetherspoon under the Spotlight

In this week’s article, we review two trading updates; one that took place this week, and one expected next week. Firstly, we take a look back at publisher Pearson (PSON) and review broker and tipster sentiment in the lead up to, and following, its most recent trading update this Wednesday. We then look forward to an expected trading update from J D Wetherspoon (JDW) next week. Has tipster broker and sentiment changed in recent months, and what will tipsters be expecting to see in the pub chain’s latest announcement?

2018 marked something of a turnaround for Pearson (PSON) – at one time the world’s largest book publisher – as the firm pushed forward with its transformation from a print publisher to a supplier of online and digital services. Shares were languishing at £5.66 late in 2017, but have since recovered ground to close last week at £10.27 – their highest level since 2015. A poor week so far (-11.7% at the time of writing) has seen the shares edge closer to £9.00, as the company’s most recent trading update revealed declining revenues in the US. It wasn’t all glum news though; despite its relatively poor performance in the States, the company is expected to declare an operating profit of £530m to £545m, within earlier guidance of £520m to £560m.

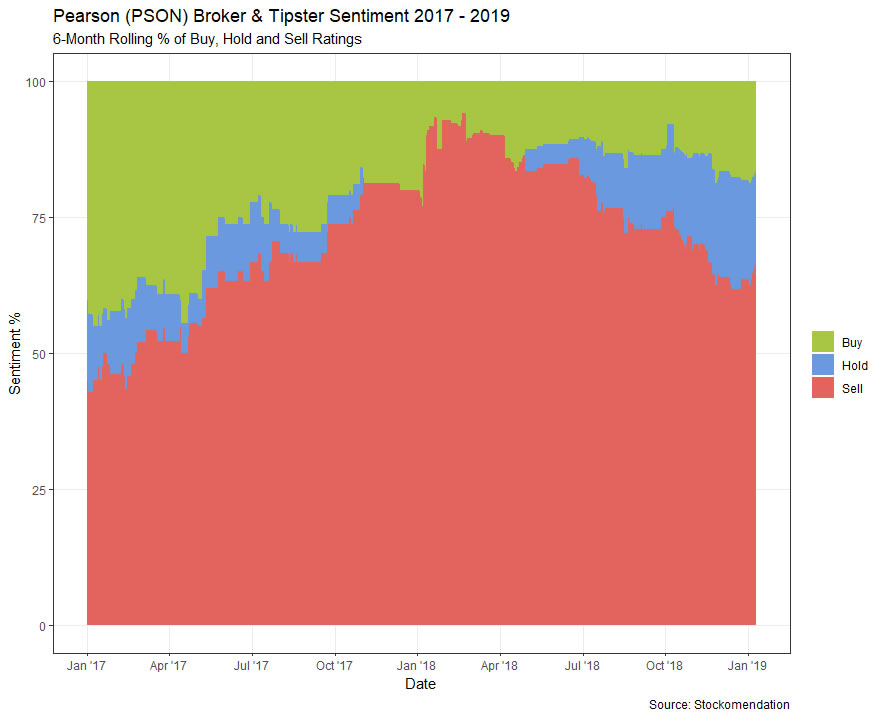

Ever since Pearson’s shares took a hammering towards the end of 2015, overall broker and tipster sentiment has historically been negative – over 50% of share tips on Pearson have expressed ‘sell’ sentiment over the last 18 months. That negative sentiment reached its peak in the six months leading up to January 2018, at which point over 85% of tips were negative. Sentiment has been steadily growing more positive since then, with tipsters more bullish than brokers in 2018; sell tips originated exclusively from brokers in the second half of 2018. Tipsters such as Malcolm Stacey (ShareProphets), Rupert Hargreaves (The Motley Fool) and Peter Stephens (The Motley Fool) have rated the shares as a buy in recent weeks, while brokers such as Liberum Capital and Deutsche Bank have been frequently reiterating sell ratings.

The most recent trading update was met with more reiterations from brokers including Berenberg, who maintain a target price of £5.50. Deutsche Bank also its sell rating while marginally increasing their target to £6.50 from £6.30, while Liberum Capital offer the lowest target (£4.50) of all brokers. In contrast, Rupert Hargreaves (The Motley Fool) issued a buy rating following this week’s trading update, noting that, as the company is “committed to restoring its reputation among income investors” there is “plenty of scope for dividend growth in the years ahead. It’s this future growth that excites me”.

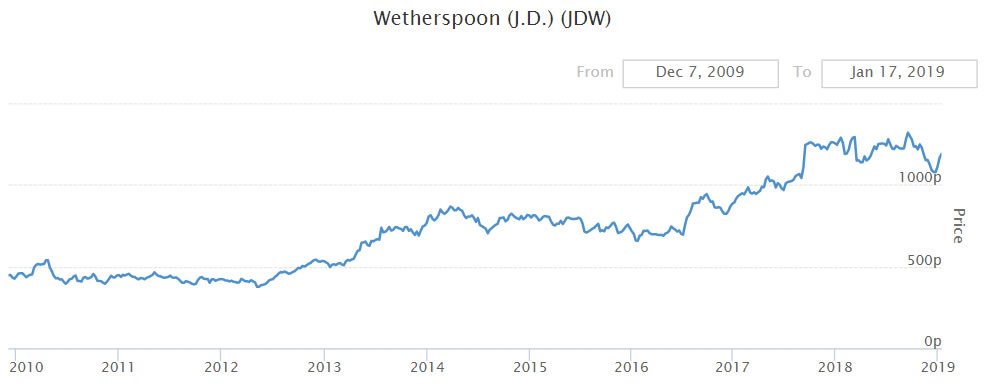

Looking forward, J D Wetherspoon’s (JDW) upcoming trading update is expected next week (Wednesday 23rd); the first of a year which has so far seen shares recovering ground from a poor end to 2018. That slump in share price at the tail end of last year came despite a like-for-like sales increase of 5.5% in the company’s Q1 trading statement, published in November.

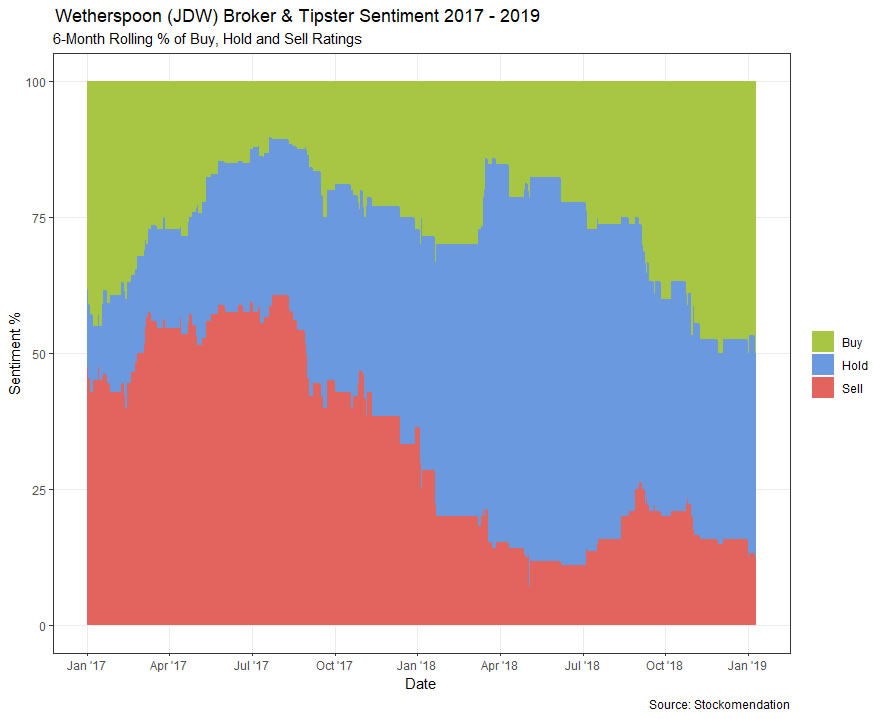

Tipster and broker sentiment has been broadly positive in recent months, with the last sell tip on JD Wetherspoon shares placed back in September 2018 (issued by broker Citi). In fact, exactly half of all share tips placed on the pub chain over the last six months have been positive ‘buy’ ratings, while only 12.5% of tips have been negative ‘sell’ ratings. Most recently, Malcolm Stacey (ShareProphets) informed readers that even if the upcoming trading update reveals that “Yule business is worse than last time….the shares should still move skywards in recent weeks”. Kevin Godbold (The Motley Fool) offered a similar opinion late last year, considering the shares to be “a decent bet for long-term growth…I think the stock is well with your research time right now”.

In terms of brokers, Berenberg issued a buy rating on the shares this week alongside a target price of £14.00, while HSBC also consider the shares to be a buy, albeit with a lower target price of £13.10. Peel Hunt and Liberum have both taken a more cautious stance, issuing hold ratings in the weeks following the firm’s most recent trading update in November.

There are now over 45,000 tips on our platform, all performance-tracked and available to view. Sign up to Stockomendation now and take a look for yourself – it’s free!

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 10th January 2019.