Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

This Week: BP Beats Estimates & an Unfortunate Week for Ocado

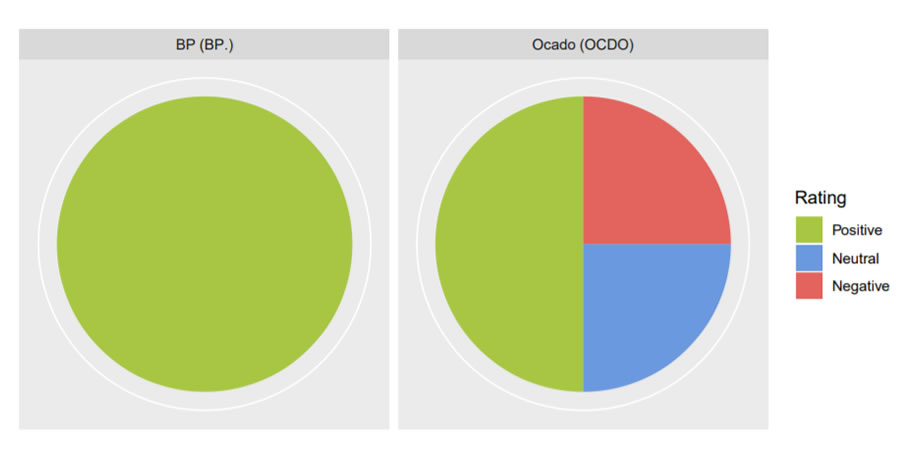

BP (BP.) and Ocado (OCDO) released annual results on Tuesday this week and the market initially responded well to both: BP finished the day up +5.2%, with Ocado +4.2%. Things have taken a turn for the worse for Ocado following news of a fire at one of its fulfilment centres in Andover. Shares in the online supermarket are -14.4% since Tuesday’s close. In this week’s article we take a look at whether these events have altered broker and tipster opinion about the future of both firms.

Broker and Tipster Sentiment in February 2019

Global oil majors have had a good run of form recently, and BP (BP.) appears to be leading from the front. Shares have achieved YTD performance of +11%, while full year results published on Tuesday revealed that full-year profits have doubled. Chief Executive Bob Dudley claims that BP’s “strategy is clearly working and will serve the company and our shareholders well through the energy transition”. Brokers and tipsters clearly agree, with a run of 28 positive broker and tipster ratings since TS Capital offered a sell rating on the shares back in November 2018.

Broker Kepler Cheuvreux reiterated a buy rating this week and raised its target price (from £6.80 to £6.90), as did Berenberg (target price raised from £6.00 to £6.10). Goldman Sachs viewed the shares as a Conviction Buy with a considerably higher target price of £7.80. UBS maintained a buy stance and a target price of £6.10, while Deutsche reiterated the shares as a buy, with the lowest target price of all ratings this week (£5.90). Shares were trading at £5.43 in early Friday trade.

Tipsters also contributed buy recommendations this week. Tom Winnifrith (Nifty Fifty) considered the shares as an income buy, reaffirming his earlier position (taken in October last year) that “the dividend was attractive whilst awaiting the shares to catch up with the operational progress” and still targeting a share price above £6.00. Malcolm Stacey (ShareProphets) offered a cautious buy rating, finding that “the PE of many home-operating companies has dipped because investors have been shunning British shares in favour of developing markets that do not suffer the negative Brexit media coverage”. Rupert Hargreaves (The Motley Fool) reiterated a buy stance, declaring the BP share price to be “the FTSE 100 buy of the decade”. Fellow Motley Fool author Peter Stephens rated the shares as a long term buy, due in part to the share price’s 6% yield. The last negative tipster opinion on BP came from G A Chester (The Motley Fool) back in August 2018.

After the share price of online supermarket Ocado (OCDO) dropped off in the second half of 2018, there’s been something of a resurgence in 2019. Shares were up almost 25% for the year (as at the end of last week) on speculation of an imminent tie-up with Marks and Spencer (MKS) – although chief executive Tim Steiner has remained tight-lipped recently. That YTD performance has dropped somewhat over the course of the week and currently stands at 13.6%. It appears that the fire at the firm’s Andover fulfilment centre – which broke out earlier this week - was worse than initially thought. Given that Andover provided “approximately 10% of [Ocado’s] current capacity…there will be a constraint on ability to meet growing customer demand”.

Broker Peel Hunt has since downgraded to a hold stance and brought its target price down considerably (from £17.00 to £10.00). However, RBC Capital labelled Ocado as a ‘Sector Performer’ on Tuesday, the same day as Numis maintained its buy rating on the shares (with no change in target price at £12.50). Shares were trading at £8.96 early in early Friday trade.

Tipsters on the other hand were less optimistic. Steve Moore (ShareProphets) still considers Ocado shares to be a sell following its full-year numbers released this week, and in the aftermath of this week’s events notes that no new fulfilment centres are set to open in 2019. As such, the tipster “wishes the company well with its returning the Andover centre to operation, but my stance on the shares remains avoid / sell”. Roland Head (The Motley Fool) also advises readers to avoid Ocado shares. As well as pointing out that the “business doesn’t make money” (with an operating loss of £31.9m for 2018), the Motley Fool author adds that “the real problem is that Ocado can’t scale up like a true tech firm”, and ultimately finds that “Ocado may end up a good business, but it’s expected to lose money again next year…in my view, the shares remain far too expensive”.

The information in this article is provided by Stockomendation, a multi-award winning Fintech50 platform allowing members access to over 45,000 performance-tracked stock tips. Sign up for FREE at www.stockomendation.com

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 7th February 2019.