Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Trading Update Review: Restaurant Group and Royal Mail

Trading updates have been coming through thick and fast over the last few days, accompanied by an influx of tipster tips and broker ratings. In this week’s article, we review two companies that have attracted the highest number of tips over the last seven days, and assess whether consensus sentiment is positive or negative in each case.

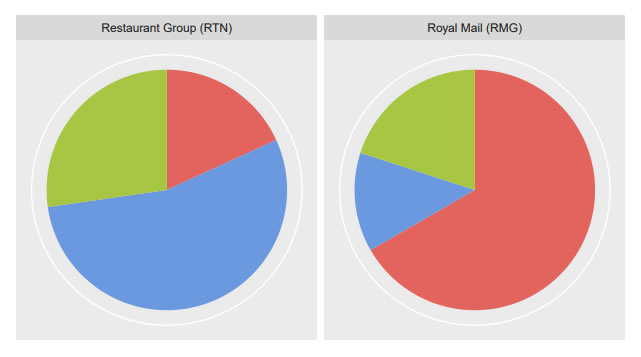

Sentiment towards Restaurant Group (RTN) shifted over the course of 2018, as brokers and tipsters shifted from a more polarised buy/sell position to a more neutral stance. Between January and August 2018, 50.0% of tips rated Restaurant Group shares as a buy, 3.3% as a hold and 46.7% as a sell. Between September and December that picture changed considerably as the proportion of hold ratings increased to 42.9%, with buys accounting for 39.2% and sells for only 17.9%. Disclosed short interest exposure in Restaurant Group (RTN) also fell over the same period, from a high of 13.5% in August last year to just under 3% in 2019.

Tip Sentiment in 2019: Restaurant Group, Royal Mail and Vodafone

Tip sentiment so far in 2019 has mirrored general sentiment at the end of last year, with a majority of tips (54.5%) in January ratings the shares as a hold. Brokers such as Liberum Capital, Berenberg and Peel Hunt reiterated neutral stances over the course over the last week, with target prices of £1.80, £1.70 and £1.60 respectively. Shares were trading at £1.50 on Thursday. RBC Capital were more positive, initiating coverage of Restaurant Group with an ‘outperform’ rating and a £2.00 target price. According to RBC, the group’s recent acquisition of Wagamama “materially improves” its growth profile. Canaccord Genuity and Shore Capital are also optimistic and award the shares a buy rating. Citi aren’t so convinced, rating the shares a sell with a target price of £1.20; that tip has so far achieved performance of +5.32% as shares fell last week.

Tipster Chris Bailey (ShareProphets) – who has been sceptical about the Wagamama acquisition since it was announced last year - advises readers to avoid Restaurant Group following its most recent trading update released this week, adding that “if they want to attract investors to this rag-tag bunch of assets, then they are going to have to try a lot harder”. However, the tipster expects “the realities around earnings, cash flow and the newly expanded debt” to become clearer when its full numbers are released in March.

Royal Mail (RMG) attracted the largest number of tips by some distance this week as shares in the courier fell almost 15% following a nine-month trading update on Tuesday. Since floating on the London Stock Exchange tip sentiment has shifted regularly, but has been marginally more positive on average (overall tip sentiment 49.6% buy vs. 28.8% sell since listing). That hasn’t been the case in 2019 though, with sell ratings account for 66.7% of all tips so far this year. Tipster Rupert Hargreaves (The Motley Fool) notes that expected operating profit of between £500m and £530m, announced on Tueday, is below management’s previous forecast and also below last year’s adjusted operating profit over the same period (£694m). The tipster concludes that “unfortunately, I don’t see a quick solution to Royal Mail’s problems, and there could be more declines ahead for investors”.

Earlier in the week, Kevin Godbold (The Motley Fool) didn’t consider the firm’s “low-margin” delivery business to be “going anywhere….the firm strikes me as being in a struggle to survive”. Fellow Motley Fool tipster G A Chester also recommends that readers avoid shares in Royal Mail, while Peter Stephens contributes the sole buy rating amongst tipsters, suggesting that “there could be scope for a turnaround”. Richard Evans (The Telegraph – Questor) is more cautious, recommending holding based on the “sustainability of the dividend” and a current price which “may equally reflect undue pessimism”, although the tipster also plans to “remain alert for any sign of a concrete threat to the dividend”. Brokers have been mainly downbeat: Credit Suisse and JP Morgan offer negative ratings, with target prices of £2.38 and £2.41, respectively. Shares were trading at £2.71 in early Friday trading. Liberum Capital (target price = £2.40) and Berenberg (target price = £2.50) have both reiterated sell ratings on the shares. The last positive broker rating on Royal Mail shares came from HSBC back in September last year.

Other popular companies this week included Vodafone (VOD) – which received mainly positive ratings following its most recent trading update, and Crest Nicholson Holdings (CRST), which brokers and tipsters were more cautious on.

There are now over 45,000 tips on our platform, all performance-tracked and available to view. Sign up to Stockomendation now and take a look for yourself – it’s free!

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 31st January 2019.