Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Add Diageo (DGE) by Stephen Wright in The Motley Fool

- Add LondonMetric Property (LMP) by Zaven Boyrazian in The Motley Fool

- Add Prudential (PRU) by Andrew Mackie in The Motley Fool

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

Hard yards ahead for UK economy

STOCKOMENDATION NEWS: This week the headlines said, ‘Hard yards ahead for UK economy:’ Top tips are a mix of SELL and AVOID with a tip breakdown 71% BUY 19% SELL and 10% HOLD this week at Stockomendation. This signals rising negativity against the recent positivity.

Luckily stock pickers can now bet against the market armed with short positions information with Stockomendation’s new U.K. FUND MANAGER SHORT POSITIONS!

1. SELL Versarien

Top interesting tip this week was SELL Versarien by none other than Tom Winnifrith in ShareProphets with an eyewatering tip performance of 33%.

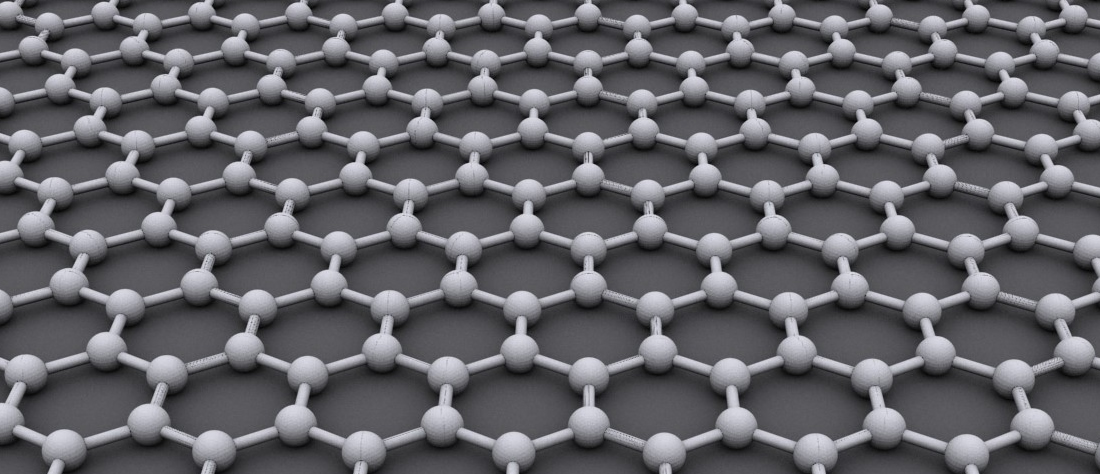

ShareProphets says it’s a ‘British success story on the other side of the globe’ but this graphene company has sported a SELL rating ever since it was first tipped in 2019. It listed in 2013 at a meagre 0.13BGP, reached the dizzying height of 1.82GBP in Sept 2018 and has since come crashing back down to 0.10GBP where it stands today.

Not quite sure what happened to cause the 2018 spike but then COVID hit as we all know, with the massive public relations disaster on graphene being included in vaccines after University of Almería, Spain found graphene oxide in the Pfizer-BioNTech vaccine.

Its CEO Neill Ricketts has been on the scandal radar for quite a number of years for his ‘friendships’ with Tory ministers & dodgy loans from Innovate UK which fleece the taxpayer.

Anyway, back to the present. Versarien has recently decided to raise £1.85m by placing 18.5m new shares at the heavily discounted share price of 10p which caused the company to lose 30% off the share price in 1 day. Ouch!! It says it wants to concentrate on the construction and leisure sectors. Versarien is down 60% in the past 12 months and whilst committed investors hold on to stock most analysts are rating it as SELL. Tom is hot under the collar about this one having warned about it for years. My favourite line from Tom’s latest piece admonishes the MP supporting Ricketts of not being a household name in his own household!! The end looks nigh for Versarien now, hold on Tom!

2. OVERWEIGHT Moonpig

Second interesting top stock pick this week was OVERWEIGHT Moonpig Group by JP Morgan with a stock pick performance of 13%.

JP Morgan’s moderate BUY recommendation might be anti instinct for one of the current largest fallers in the FTSE 250 but Overweight it is for this London premium online greeting card and gift merchant. This rating is not a change of direction but a reiteration of the same rating JP Morgan placed since the first one in March 2021.

Why? Well, Royal Mail (aka Royal Mess) strikes are affecting sales and the company has issued a profit warning due to the posties’ decision to put their feet up. Time for Moonpig executives to divest and find another courier! JP Morgan sets a target price of a whopping 3.20GBP which for a company currently trading at less than £1.40 and no good news on the horizon that we can see, is an interesting rating to observe!

3. AVOID Gooch & Housego

Third interesting top tip this week was AVOID Gooch & Housego by Steve Moore in ShareProphets with a stock pick performance of 7%.

Big news is that insider Chair Gary Bullard bought 75% more stock for £60,000 at £4 per share.

We find a strong order book despite an annual loss and lower share price for this Somerset photonics company. Revenue has grown and orders are much higher than last year.

Gooch & Housego opened 1.27GBP in 1997, popped up to 18.80GBP in 2018 and is now at £4.29.

Some say G&H shares are currently valued at less than 65% of their true value, some say earnings are forecast to grow around 66%, analysts concur that the share price should rise by 92% - the picture is complex at Gooch & Housego and there is never any harm in taking a closer look.

UK Fund Manager Short Positions

See which UK Fund Managers are betting against your investments by accessing current & historical short positions on UK companies showing you which fund manager has shorted which company and by how much.

CASH PRIZES ARE BACK!

Think you can pick stocks? Play the October league UK Share Picking game FREE for your chance to win cash prices : uksharepickinggame.co.uk

Disclaimer: The contents of this article should not be considered financial advice. Pricing data correct as at 8th December 2022.