Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

A Tough Week for ASOS: Broker and Tipster Opinion

The biggest casualty of the week was online fashion retailer ASOS (ASC), which was toppled from its position as the most valuable company on AIM after shares sunk by 50% this week. Investors were spooked by the company’s trading update for the first three months of the financial year – released on Monday – warned of a “significant deterioration in the important trading month of November and conditions remain challenging”. After three years of impressive returns, 2018 had already proven a fairly rough year for holders in ASOS prior to this week’s events. Still, brokers and tipsters (on the whole) have been bullish about the future prospects of the company.

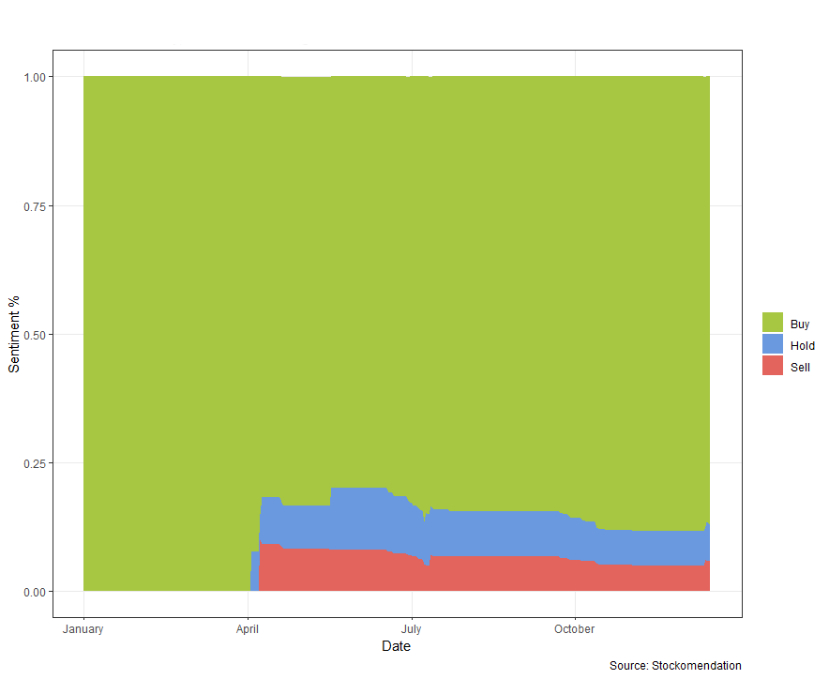

ASOS Broker & Tipster Sentiment in 2018

Cumulative % of Buy, Hold and Sell Ratings

A list of brokers including HSBC, Societe Generale and UBS have reiterated buy ratings on ASOS shares in recent days. The highest target price of recent tips comes from UBS (£75.00), while Jefferies have revised their target price to £35.00 and Liberum – the only broker to downgrade to a hold stance this week – offer a revised target price of £28.00. The average target price from unique tips in the last week is £49.31. The last sell rating from a broker came in in August this year from Canaccord Genuity.

Tipsters have been less positive in their outlook towards ASOS shares in 2018; 30% of tipster tips have advised readers to either ‘Sell’ or ‘Avoid’. Back in April, ShareProphets author Steve Moore tipped the company as a sell, considering margins to be “unimpressive” and warning of increases in net debt. Fellow ShareProphets author Malcolm Stacey suggested caution back in July, calling ASOS “a slowing share” and noting that the “high P/E tells its own story”. Most recently, this week Roland Head (The Motley Fool) slapped an ‘avoid’ rating on ASOS shares following Monday’s trading update, warning of a potential drop in EPS of around 55% for the current financial year and suggesting caution “given the newly uncertain outlook for profit growth”. However, Miles Costello (The Times) was more positive on ASOS last month and awarded the shares a buy rating, given “the opportunities for growth, both geographically and in online shopping”.

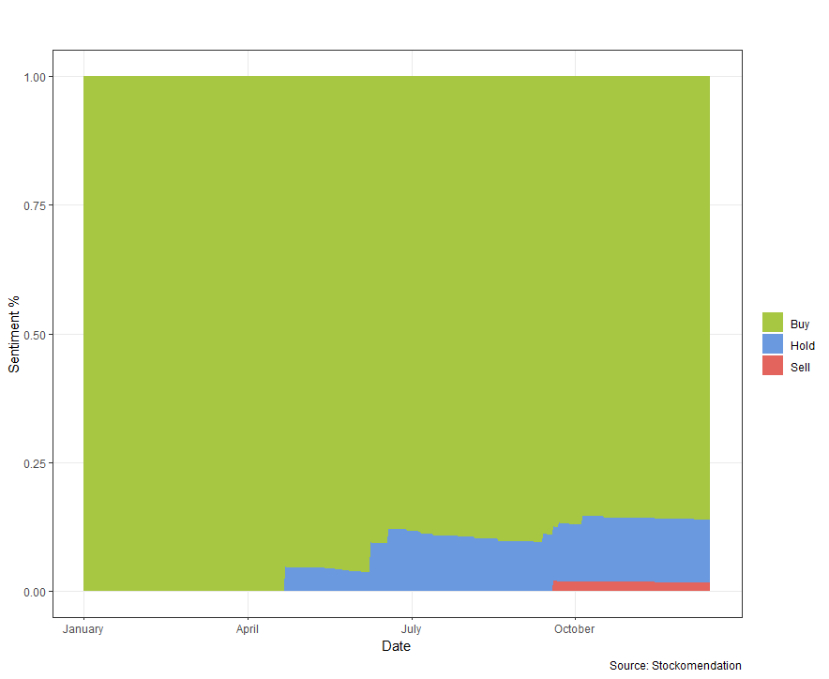

Despite being quick on the draw in issuing a reassuring announcement to ease investor anxiety on Monday, there appeared to be some read-across in the sector with shares of Boohoo Group (BOO) down 15.5% so far this week, although brokers and tipsters are still overwhelmingly optimistic about the retailer’s outlook. Boohoo has shared a similar sentiment to ASOS this year; primarily positive with an increase in sell and hold sentiment from late-spring. Roland Head (The Motley Fool) this week issued a hold recommendation on the basis that “the shares still look quite fully priced” even despite this week’s slump, though the tipster is convinced that “boohoo is a better business than ASOS”. The Analyst Team at the Share Centre early this month considered Boohoo to be a “jolly stock to thaw your portfolio this festive season” for medium to high risk investors. In amongst the sea of positive financial commentary and bullish broker notes, there can be value in exposing yourself to a contrarian viewpoint. Stockomendation users can access our dataset of over 17,000 tips this year – offering a diverse range of opinions and analysis for free.

Boohoo Group Broker & Tipster Sentiment in 2018

Cumulative % of Buy, Hold and Sell Ratings

There are now over 45,000 tips on our platform, all performance-tracked and available to view. Sign up to Stockomendation now and take a look for yourself – it’s free!

Disclaimer: The contents of this article should not be considered financial advice. All information displayed as at 20th December 2018.