Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Buy KEFI Gold and Copper (KEFI) by Hot Stock Rockets in ShareProphets

- Hold Lloyds Banking Group (LLOY) by Alan Oscroft in The Motley Fool

- Buy Xaar (XAR) by Berenberg

- Sell Corero Network Security (CNS) by Steve Moore in ShareProphets

- Sell Everyman Media Group (EMAN) by Steve Moore in ShareProphets

- Hold BP (BP.) by Tom Winnifrith in ShareProphets

- Hold BP (BP.) by Steve Moore in ShareProphets

- Buy Fresnillo (FRES) by Citi

- Buy RM (RM.) by Steve Moore in ShareProphets

- Buy Capital Limited (DI) (CAPD) by Steve Moore in ShareProphets

- Hold JD Sports Fashion (JD.) by Mark Hartley in The Motley Fool

- Speculative Buy Kodal Minerals (KOD) by Canaccord Genuity

- Buy Renew Holdings (RNWH) by Peel Hunt

- Sell Crimson Tide (TIDE) by Steve Moore in ShareProphets

- Hold Glencore (GLEN) by Harvey Jones in The Motley Fool

- Hold Burberry Group (BRBY) by Harvey Jones in The Motley Fool

- Add Aviva (AV.) by Andrew Mackie in The Motley Fool

- Hold Lloyds Banking Group (LLOY) by Dr. James Fox in The Motley Fool

- Hold BP (BP.) by Harvey Jones in The Motley Fool

- Hold Lloyds Banking Group (LLOY) by Alan Oscroft in The Motley Fool

Resilience Despite Mixed Global Market

The FTSE 100 index traded down this week, falling -0.77%, showing some resilience despite mixed global market signals. Investor sentiment remains tilted towards the upside, with all tips this week a mix of 67% BUY, 18% HOLD and 15% SELL.

1. BUY Bloomsbury Publishing (BMY)

Top performing stock pick this week is BUY Bloomsbury Publishing by Berenberg with a tip performance of 4.68%.

Bloomsbury Publishing plc is a London-based independent publishing house, best known for publishing the Harry Potter series and a diverse catalogue across academic, professional, adult, and children’s markets. It is listed on the London Stock Exchange and a constituent of the FTSE SmallCap Index.

The company’s share price started at 470.50p when the tip was made on 27th August and has since risen to 492.50p. Berenberg has set a target price of 825.00p, suggesting further upside potential.

In Stockomendation there are two open UK fund manager short positions reported, view those here.

2. OUTPERFORM Oxford Biomedica (OXB)

Second top performing stock pick this week is OUTPERFORM Oxford Biomedica by RBC Capital with a tip performance of 3.82%.

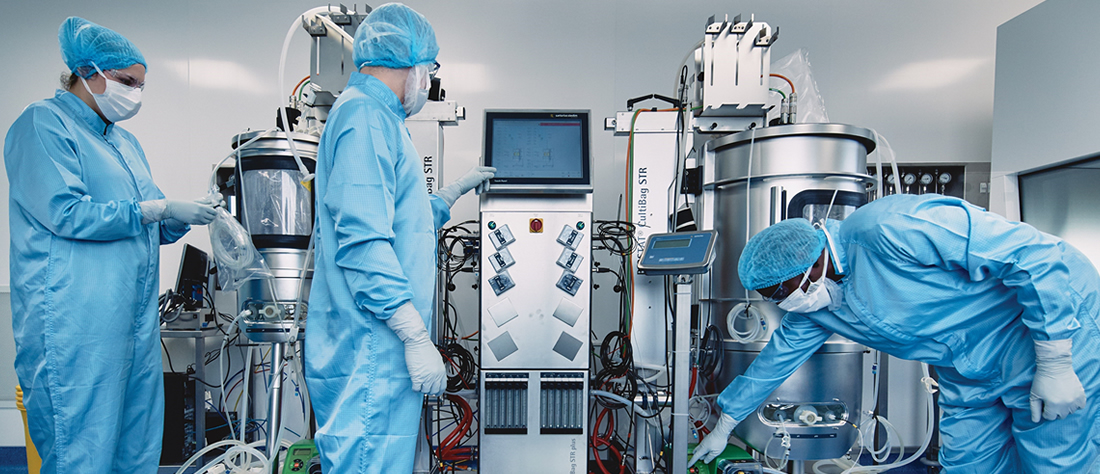

Oxford Biomedica plc is a gene and cell therapy company headquartered in Oxford, UK. The business develops and manufactures viral vectors for leading pharmaceutical partners, with a strong position in the fast-growing cell and gene therapy sector. It is listed on the London Stock Exchange and is part of the FTSE 250 Index.

The company raised £60 million via a share placing and subscription, backed by its Chair, Dr Roch Doliveux, who personally bought 67,000 shares at ~449.75p, increasing his stake to 0.41%. This underlines internal belief in future growth.

The tip was made on 26th August at a price of 550.00p, and the share price has since increased to 571.00p. RBC Capital has set a target price of 930.00p, reflecting confidence in the company’s long-term growth prospects.

In Stockomendation there are two open UK fund manager short positions, view those here.

3. BUY Vesuvius (VSVS)

Third top performing stock pick is BUY Vesuvius by Jefferies with a tip performance of 2.74%.

Vesuvius plc is a global leader in molten metal flow engineering and technology, providing advanced solutions to the steel and foundry industries worldwide. It is listed on the London Stock Exchange and a constituent of the FTSE 250 Index.

Yet, technical indicators turned cautious: the share price dipped [http://Yet, technical indicators turned cautious: the share price dipped below its 200-day moving average, and analysts are split, with a “Moderate Buy” consensus on a 380p target—highlighting near-term volatility.]below its 200-day moving average, and analysts are split, with a “Moderate Buy” consensus on a 380p target—highlighting near-term volatility.

The company’s share price stood at 364.80p when the tip was made on 27th August and has since risen to 374.80p. Jefferies has set a target price of 500.00p, highlighting confidence in the company’s strong market position and global demand trends.

In Stockomendation there is 1 open UK fund manager short positions, view those here.

Join Now

Think you can pick stocks? Play the September league UK Share Picking game FREE : uksharepickinggame.co.uk

Disclaimer: The contents of this article should not be considered financial advice. Pricing data correct as at 28th August 2025.