Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Month in Review : July 2018

The previous record number of tips captured and performance-tracked by Stockomendation was smashed in July, with over 1,600 new stock tips and broker ratings added to our platform across 23 brokers and 40 professional tipsters. Tip activity in July was the at its highest since April – coinciding with quarterly trading updates for many firms – representing an increase of 81% on the number of tips tracked during the same period last year. This surge in tips was mainly driven by brokers, with tipster activity remaining in line with previous months.

Unlike June, which saw brokers sentiment increase while tipster sentiment declined, July saw both brokers and tipsters grow more bullish towards LSE-listed firms. The percentage of all broker ratings signalling a ‘buy’ rating in July increased to 71.8% from 70.1% in June, while ‘sell’ ratings decreased from 4.7% to 4.3%. Particularly high levels of broker sentiment were observed across the Tobacco, IT Services and Engineering sectors.

Tipster sentiment grew more positive in July, but was still considerably below that of brokers. ‘Buy’ ratings accounted for 62.4% of all tipster tips in July, up from 60.1% in June. The proportion of sell tips from tipsters decreased from 29.2% to 25.4% over the month. Tipsters still therefore appear more sceptical about the prospects of LSE firms, though overall sentiment has increased. The IT Hardware sector proved to be the most divisive between brokers and tipsters this month; 9 of 12 broker ratings in the sector were ‘buys’ and the remainder were ‘holds’. In contrast, all 15 tipster tips in the sector offered ‘sell’ recommendations. So far, tipsters seem to have made the better calls however, with average performance of +3.85% for new tips this month compared to an average broker performance of -1.38%.

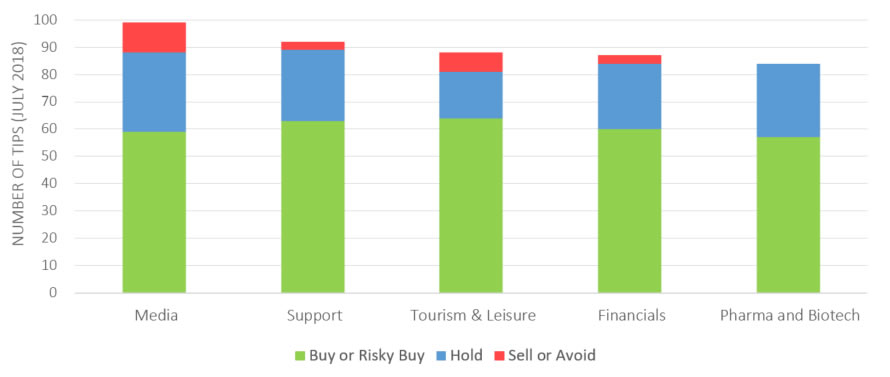

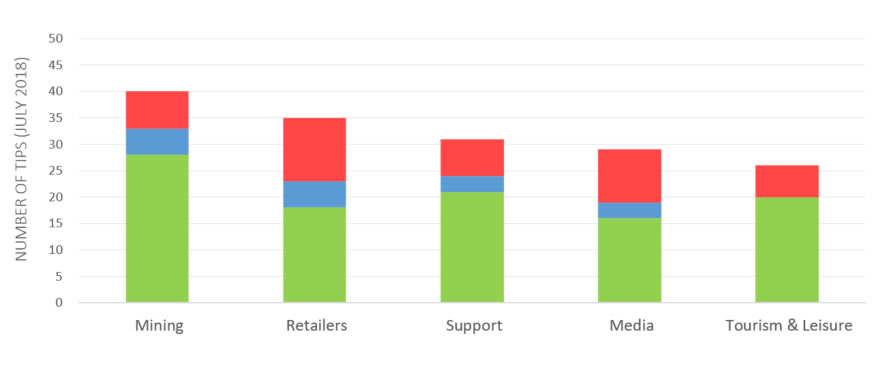

As can be seen from the chart below, brokers and tipsters again focussed on broadly similar sectors in July; with Media, Support and Tourism & Leisure in the top five most frequently tipped sectors for both. However, the two were not as aligned as June, partly due to a reduction in broker scrutiny on Retailers over the last month, and tipsters switching focus from financial firms.

Brokers focused primarily on Media companies in July, with the Support sector demoted from the top spot it occupied last month, while Pharma & Biotech again drew a great deal more scrutiny from brokers than tipsters this month (84 broker ratings, 12 tipster tips). Sentiment remained bullish in the sector among brokers, although less so than last month. ‘Buy’ ratings accounted for 67.9% of the total tip count, with no sell recommendations.

The Media Sector Attracted The Most Broker Attention in July

... Where As The Mining Sector Again Received The Most Tips From Tipsters

Tipsters were most active in the Mining sector for the second month running, while the number of tips towards Support firms increased and focus on the Tourism and Leisure sector decreased. For the second straight month sentiment in the Mining sector decreased amongst tipsters however; 70.0% of new tipster tips in July awarded a ‘Buy’ rating, down from 78.8% in June and 100.0% in May.

Brokers saw the most success in their recommendations towards investment firms; the 5 tips yielded average performance of 10.1%, compared to tipster performance of -0.3% in the sector. Broker performance was mainly driven by Burford Capital (BUR), whose shares rose 23% during a month in which is announced positive interim results. New broker recommendations also performed well in Manufacturing (+3.3%), Financials (+3.2%) and Telecom Operators (+3.1%).

Tipsters excelled in Pharma and Biotech, achieving average new tip performance of 10.0%.0 ‘Buy’ tips made on OptiBiotix (OPTI) drove the tip average in this sector after shares surged 64.9% during the month. Further strong tipster performances were noted in Industrial Chemicals (+9.7%) and Tobacco (+4.9%). Industrial Chemical also produced the highest average tip performance when brokers and tipsters were combined (+5.0%), while tips in the Leisure Products sector produced the poorest performance of the month (-7.52%).

Gary Newman of ShareProphets claimed July’s top tip; the tipster’s ‘buy’ recommendation placed on AIM-listed energy producer Regal Petroleum achieved performance of +70.90% at the close of July 31st.

Finally, the most-frequently tipped companies differed between tipsters and brokers in July. GlaxoSmithKline (GSK) and ASOS (ASC) attracted the highest number of broker ratings (15 each), while Tipsters instead focussed the most attention on Purplebricks Group (PRP) and ITV (ITV) (8 and 7 tips).

Here at Stockomendation, we’re constantly investing new ways to identify the leading brokers and tipsters for you to follow in each sector, and for each company. Watch this space for upcoming features enabling you to do this, and much more. The current platform allows you to performance-track nearly 40,000 stock tips, and see which companies and sectors are currently trending on your ‘Dashboard’. Sign up now and take a look for yourself – it’s FREE!

Disclaimer: The contents of this article should not be considered financial advice. All information correct as at 31st July 2018.