Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Tipsters Sentiment Mirrors Mining Sector Performance in 2018

It’s been a tough few months for the mining sector in 2018, with the All Share Mining Index down over 10% since the beginning of the year and mining shares hitting a two-year low last week. Precious metal miners in particular have suffered a rough summer; the price of gold now sits at $1,196, down from $1304 on 1st January, while Holders of some of the larger companies in this sector – such as Fresnillo (FRES), Centamin (CEY) and Hochschild (HOC) – will have seen the losses of over 30%. It’s not all doom and gloom in the sector though: success stories can be found amongst the small-caps, with Gem Diamonds (+57% in 2018) and Atalaya Mining (+26.1%) heading the list of miners that have provided strong returns so far.

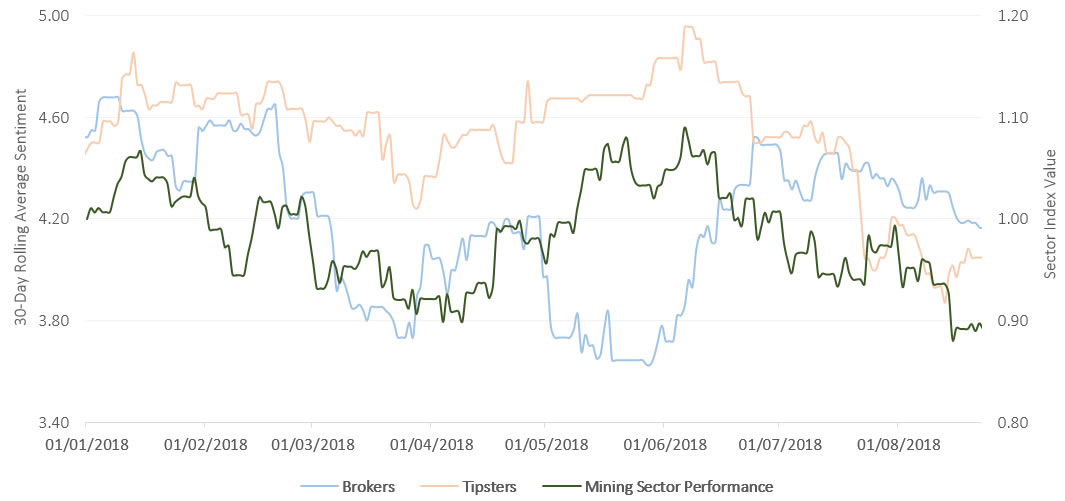

This week, we took a look to check for trends in tipster and broker sentiment towards mining firms this year. The results are shown in the chart below, which plots broker and tipster sentiment through the year (where a ‘buy’ rating is given a score of 5, and a sell rating a score of 1) against the performance of the mining sector (the index is given a base score of 1 at the beginning of the year). Sentiment shown is a 30-day moving average of the daily sentiment score. What’s really striking is the strong correlation between tipster sentiment and sector performance on a consistent basis through the year. We’re currently running some analysis on causality and prediction accuracy, but a quick glance at the chart shows some occasions when tipster sentiment does appear to pre-empt changes in future performance; for example, sentiment recovered from a downward trend in the spring, with shares following suit a couple of weeks later – although at other times sentiment and performance move in tandem.

Tipster and Broker Sentiment vs. Sector Performance in 2018: Mining

The same can be said for brokers during the spring months, but otherwise the opinion of brokers and sector performance diverge completely, especially earlier on in the year (February) and during the months of May and June. As a result, the correlation between the two is near zero. So, why the chasm between tipster and broker sentiment movement? For the moment, its speculation – but it may suggest that professional tipsters are more tuned into the market – in this sector, at least – and better placed to respond quickly to changes in market conditions. Or perhaps it’s the case that brokers are looking at long-term shifts in the market, and paying less focus to those movements in between?

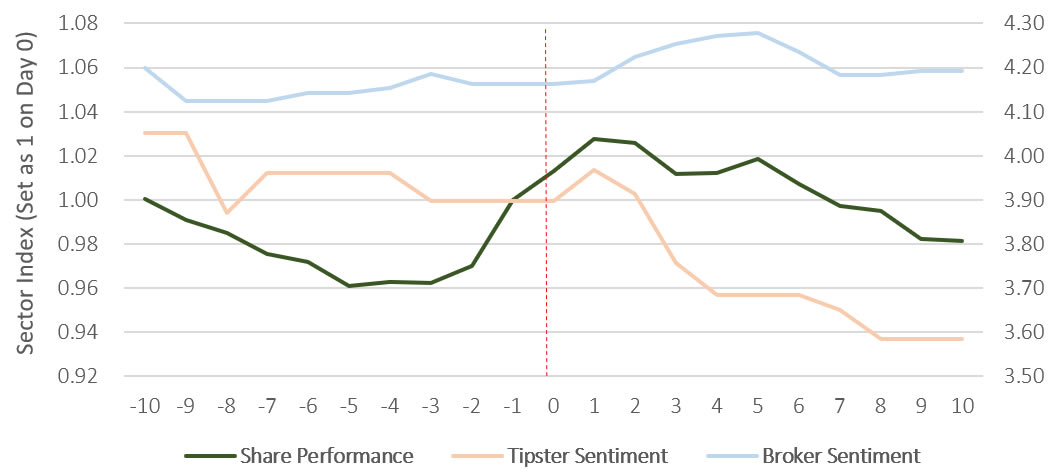

The below chart adds further weight to the argument that tipsters perhaps respond more rapidly to public news. In this chart, tipster and broker sentiment during the ten days before and after a mining company publishes a drilling report (when a mining company publishes the findings of its drilling operations) are shown. Firstly, it’s interesting to see that the share price rise in the two days prior to an announcement is greater than that afterwards! But as well as that, while broker sentiment remains almost static during the period (partly due to a low number of broker notes during this period), tipster sentiment moves much more in line with share returns. Perhaps it is the case then that tipsters are quicker on the draw when it comes to interpreting and publishing news in the mining sector.

Tipster & Broker Response to Drilling Reports

That being said, there have been some outstanding calls from both brokers and tipsters so far this year. It’s all about filtering out the noise and showcasing the top tips and tipsters in a specific sector, and that’s what we’re currently working towards with the team here at Stockomendation.

Our current platform allows you to performance-track over 40,000 stock tips from over 330 tipsters and brokers. Sign up now and take a look for yourself – it’s FREE!

Disclaimer: The contents of this article should not be considered financial advice. Data accurate as at 24th August 2018..