Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Hold Greggs (GRG) by Royston Wild in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

Experience Can Pay Off For Professional Share Tipsters

There is nothing like losing all you have in the world for teaching you what not to do. And when you know what not to do in order not to lose money, you begin to learn what to do in order to win. Did you get that? You begin to learn!

Edwin Lefevre, Reminiscences of a Stock Operator (1923)

The adage “good judgement comes from experience, and experience comes from poor judgement” can ring particularly true for retail investors, for whom that initial foray into the stock market can provide a steep learning curve, littered with rash judgements and poor advice. A study conducted by researchers in 2011 found that a similar trend applies to broker analysts, with buy recommendations from more experienced analysts outperforming those with less experience (though interestingly they found the reverse to be true for sell tips).

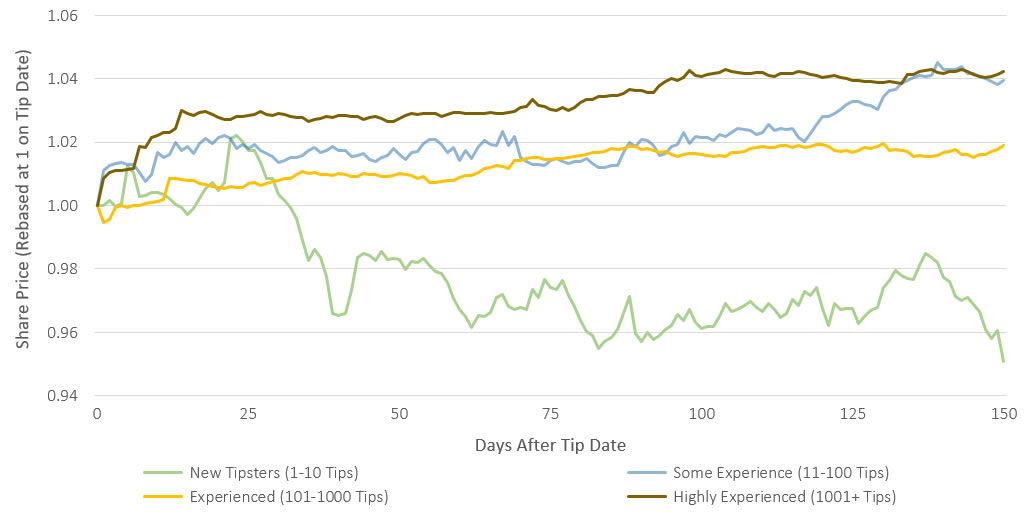

This week, we’ve been running some analysis to establish whether similar trends exist for stock tipsters, too. Do those with more tipping experience outperform those that have just started out? In the below chart, we use the number of tips we’ve performance-tracked on Stockomendation for each tipster as a proxy for experience. For example, a tipster with over 1,000 tips is considered to be highly experienced, whereas a tipster with less than ten tips is considered to be new to the game. It’s not a perfect measurement of financial market experience (some tipsters may have worked within a broker before becoming a professional tipster, for example) but it gives us a general idea of experience.

The chart shows an index of tip performances for each experience category in the first 150 days following publication of a “Buy” or “Risky Buy” recommendation. Anything below an index value of 1 suggests that the average tip produced negative performance, anything above 1 suggests positive performance. So, what do we find here?

Firstly, it is perhaps no surprise to find that the more highly experienced tipsters provide the best performance over 150 days (+4.44%). There’s perhaps an element of survivorship bias here – if a tipster has a poor record of picking tips, then it’s less likely that they’re still going to be tipping after 1,000 tips. Interestingly though, over half this performance is captured in the first 10 days (+2.22%) – though this could purely reflect good stock-picking, it could also indicate the influence that experienced tipsters have in the markets.

Experience Can Pay Off For Tipsters

The performance of new tipsters (those with ten tips or less) is negative over the 150 day period (-4.92%), suggesting that tipsters perhaps do indeed learn from their mistakes (or alternatively, stop tipping) over time. However, unlike the earlier-mentioned performance of broker analyst recommendations, the relationship between tipster experience and performance is not so clear.

For example, the ‘Some Experience’ tipster category (including those tipsters with between 11 and 100 tips) produces similar performance (+3.94%) to highly experienced tipsters, and again over half of this performance is gained early (9 days). Experienced tipsters (those with between 101 and 1000 tips) achieve lower performance than this, despite having more experience. Tip performance for this experience category was much more gradual and – like highly experienced tipsters – their performance seems to stagnate after the first three months. Perhaps tipping, like all investing, offers a steep learning curve to those new to the game.

Some things to note; these performances are not market-adjusted, and tipsters may typically have a longer (or shorter) time horizon than 150 days in mind. This is just a lighter version of the work we’re doing behind the scenes here at Stockomendation. There are also, of course, new tipsters who can outperform the most established of tipsters, and so this is certainly not to say that new tipsters aren’t worth listening to. It’s all about “filtering out the noise” and identifying those that are worth following. That’s what we’re aiming for at Stockomendation.

Our current platform allows you to performance-track nearly 40,000 stock tips from over 300 tipsters and brokers. Sign up now and take a look for yourself – it’s FREE!

Disclaimer: The contents of this article should not be considered financial advice. Data used for the analysis in this study includes tips made between 1st January 2017 and 9th August 2018. Pricing data correct as at 9th August 2018..