Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Avoid YouGov (YOU) by Steve Moore in ShareProphets

- Avoid Warpaint London (W7L) by Steve Moore in ShareProphets

- Buy Vodafone Group (VOD) by DZ Bank

- Watch Mony Group (MONY) by Simon Watkins in The Motley Fool

- Add BP (BP.) by Andrew Mackie in The Motley Fool

- Buy Taylor Wimpey (TW.) by Simon Watkins in The Motley Fool

- Reduce Safestore Holdings (SAFE) by Kepler Cheuvreux

- Add S&U (SUS) by Peel Hunt

- Buy Mitchells & Butlers (MAB) by Deutsche Bank

- Sell Croda International (CRDA) by Goldman Sachs

- Neutral Rio Tinto (RIO) by UBS

- Neutral Rio Tinto (RIO) by Citi

- Buy Antofagasta (ANTO) by Citi

- Buy Glencore (GLEN) by Citi

- Neutral LondonMetric Property (LMP) by Goldman Sachs

- Neutral Drax Group (DRX) by Goldman Sachs

- Outperform Serco Group (SRP) by RBC Capital

- Equal Weight Safestore Holdings (SAFE) by Barclays

- Overweight Big Yellow Group (BYG) by Barclays

- Buy Legal & General Group (LGEN) by Berenberg

Lenders flying blind

Lenders flying blind on private equity risk and all stock picks are a mix of 11% HOLD, 76% BUY and 13% SELL

1. AVOID Aferian

Top stock pick this week AVOID Aferian by Steve Moore in ShareProphets with a tip performance of 12%.

Aferian is a B2B video streaming services company founded in 1997.

Aferian share price launched on the AIM market in 2004 at 139p, reached an all-time high of 308p in 2005 and is today at 7.5p.

On the 22nd of April it release two RNS feeds one Trading Update and one Board Change announcing the stepping down of the current CEO Donald McGarva who had held post for 14 years.

In his article Moore questions the positive tone of the Trading Update albeit announcing a lower than expected EBITDA and questions the recent share price drop in comparison.

In Stockomendation Moore is the only analyst with AVOID and there are no active short positions open.

2. BUY Oxford Nanopore

Second stock pick this week is BUY Oxford Nanopore Technologies by HSBC with a tip performance of 8%.

Oxford Nanopore develops and sells nanopore sequencing products for the direct, electronic analysis of single molecules.

Oxford Nanopore share price launched on London Stock Exchange at 615p in 2021, reach an all-time high of 710p a few months later and is today at 101p.

This tip was made on 22 April, 4 days after Berenberg reiterated its BUY rating and issued a 350p price target. Citigroup also reiterated its BUY rating.

In Stockomendation four out of four analysts rate it as BUY or OVERWEIGHT they are Berenberg, HSBC, Citi and JP Morgan. There are no active short positions open.

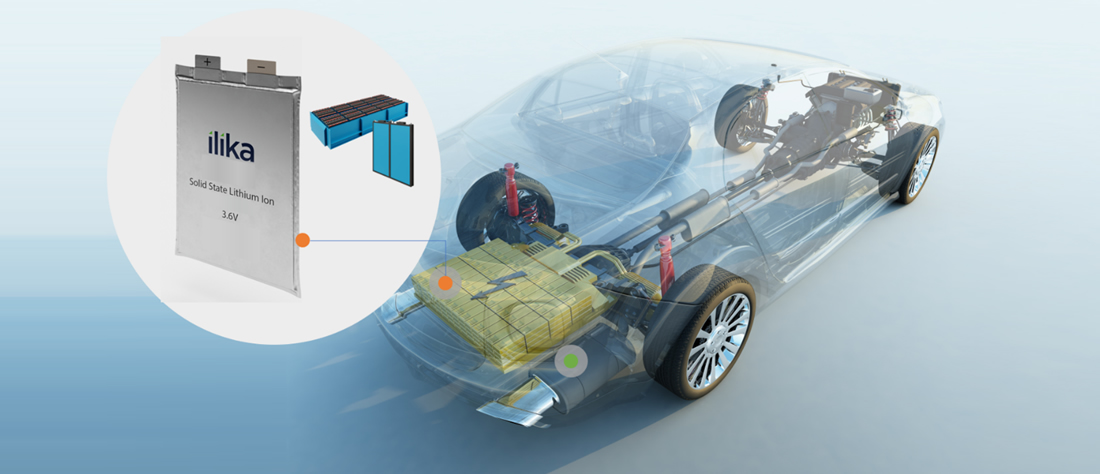

3. BUY Ilika

Third interesting stock pick this week is BUY Ilika by Berenberg with a tip performance of 4%

Founded in 2004, Ilika designs, develops, and produces solid-state batteries under the Stereax name primarily in the United Kingdom, Asia, Europe, and North America. Its batteries are sold under the brand name Stereax.

Ilika launched on the AIM market at 56p in 2010, rose to an all-time high of 261p in 2021 and is today at 27p.

On 23rd April in this RNS the company announced its Capital Markets Day and Trading Update which announced trading in line with expectations and cash higher due to grant funding and cost reductions.

In Stockomendation Berenberg says BUY and Steve Moore says AVOID. There are no active short positions.

UK Fund Manager Short Positions

See which UK Fund Managers are betting against your investments by accessing current & historical short positions on UK companies showing you which fund manager has shorted which company and by how much.

Think you can pick stocks? Play the March league UK Share Picking game FREE : uksharepickinggame.co.uk

Disclaimer: The contents of this article should not be considered financial advice. Pricing data correct as at 26th April 2024.